Question: e. Salaries Expense is overstated by $700 E. A $300 cash payment for advertising eopense was neither journalized not posted g. A S200 cash dividend

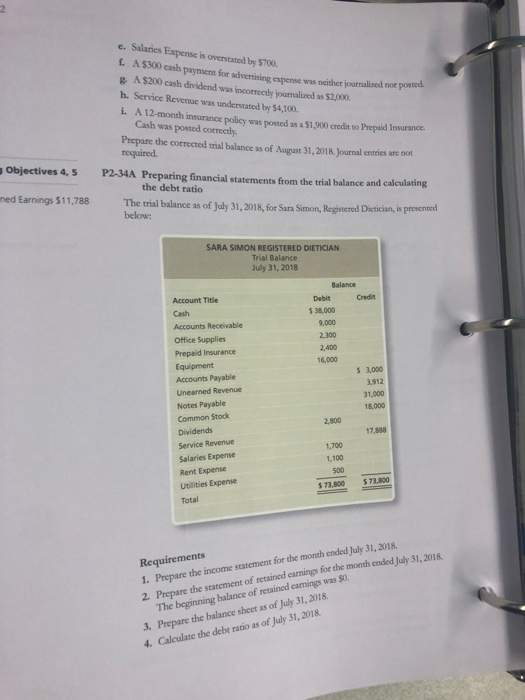

e. Salaries Expense is overstated by $700 E. A $300 cash payment for advertising eopense was neither journalized not posted g. A S200 cash dividend was incorrectly journalized as S2000. h. Service Revenue was understated by $4,100. I. A 12-month insurn Cash was posted correctly 5, cl o Perpd lesurne Objectives 4,5 P2-34A Preparing financial statements from the trial balance and calculating ned Earnings $11,788 The trial balance as of July 31, 2018,for Sara Simon, Regstered Dietician, is presentd Prepare the corrected trial balance as of August 31,2018 Journal entries are not required. the debt ratio below: SARA SIMON REGISTERED DIETICIAN Trial Balance July 31, 2018 Account Title Cash Accounts Recelivable Office Supplies Prepaid Insurance Equipment Accounts Payable Unearned Revenue Notes Payable Common Stock Debit Credit 5 38,000 9,000 2,300 16,000 s 3,000 3,912 1,000 18,000 17,888 Service Revenue Salaries Expense Rent Expense Utilities Expense Total 1,700 1,100 500 73,800 73,800 Requirements 1. Prepare 2. Prepare the statement t for the month ended July 31,2018. retained earnings for the month ended July 31, 2018 the income statement The beginning balance of retained carnings was $o 3. Prepare the balance sheet as of July 31, 2018 4. Calculate the debt ratio as of July 31, 2018

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts