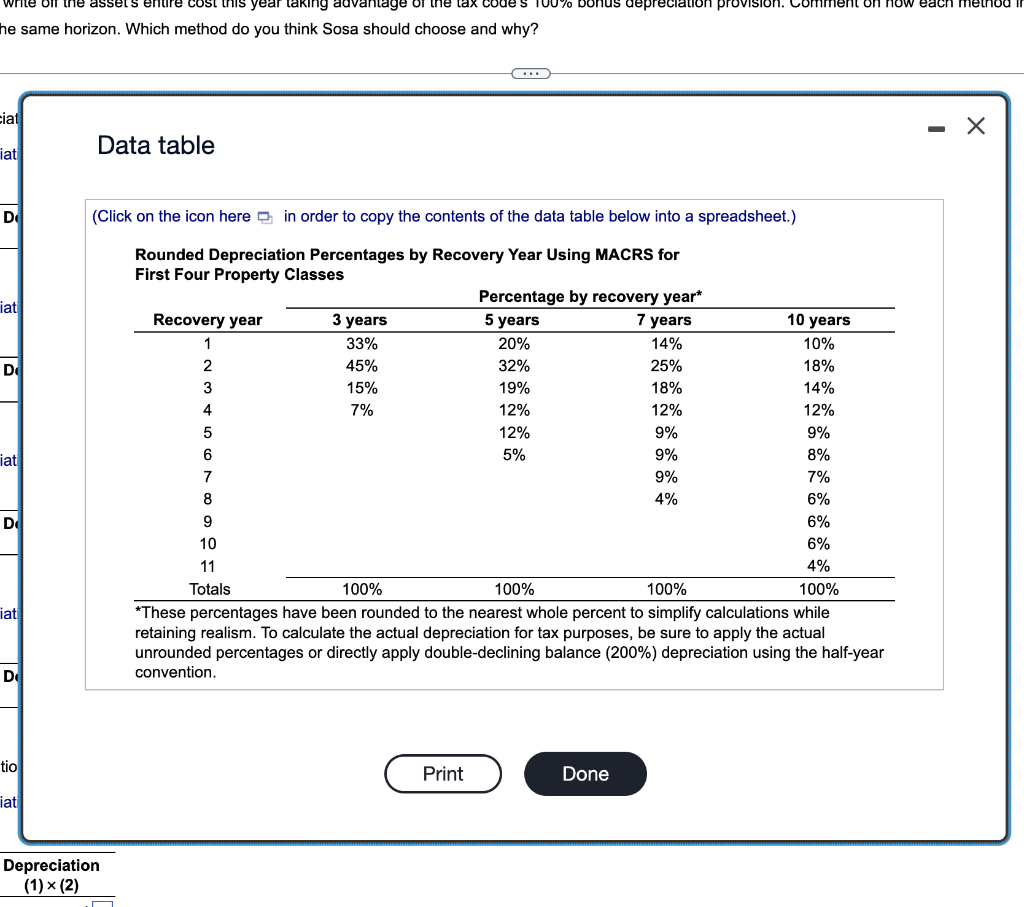

Question: e same horizon. Which method do you think Sosa should choose and why? Data table (Click on the icon here in order to copy the

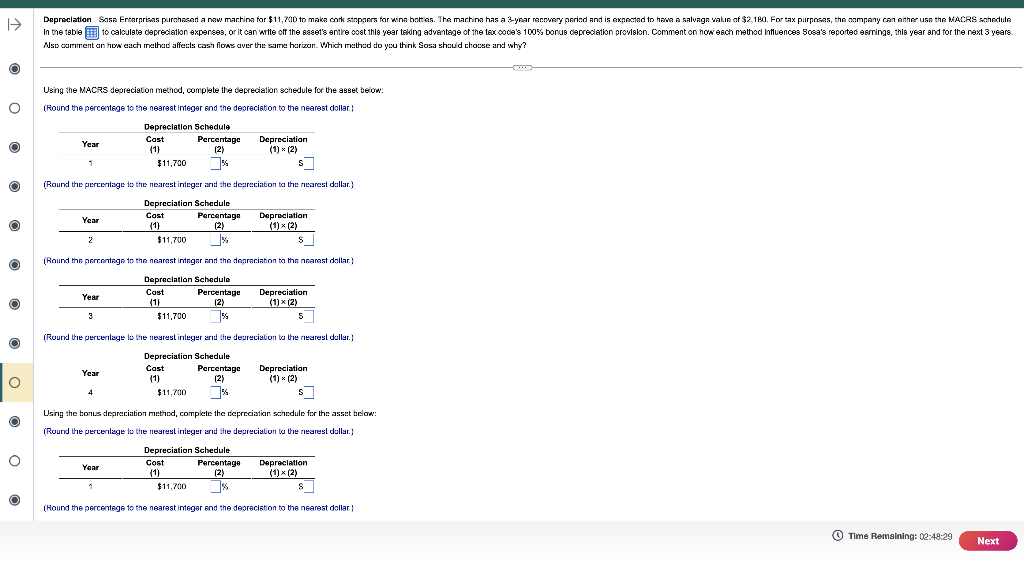

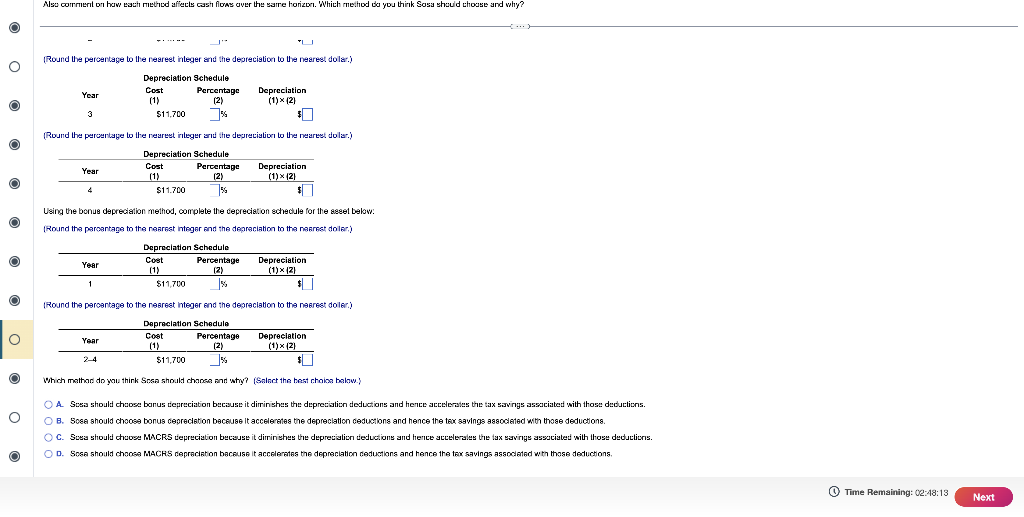

e same horizon. Which method do you think Sosa should choose and why? Data table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes These percentages have been rounded to the nearest whole percent to simplify calculations while retaining realism. To calculate the actual depreciation for tax purposes, be sure to apply the actual unrounded percentages or directly apply double-declining balance (200%) depreciation using the half-year convention. Ass carmment an how each methadd affects cassh floss aver the samre harizon. Which methad do you think Sosa shaud thonse and why? Using the MACRS depreciation method, complate the depreciation schedule for the asset beiow: (Round the percentege to the nearest integer end the deprecietion to the nearest dollar.) (Round the pereertegge to the nearest integer arad the deareciation ta the nesrest dellar.) (Round the perenentage to the nearest intngar nad the degreciation to the nearest dallar.) (Round the percerilege to the nesrest inleger arid the dejreciation ta the reearesl dellar.) Using the bonus depreciation muthed, complete the reprrciation schedule for the asset below: (Round the percerlege to the nesrest inleger arid the deureciation ta the resarest dallar.) (Found the percentege to the nearest integer end the deareciation to the nearest dollar: (Round the percentage to the reareet integer ard the depreciation to the neareet dolar.) (Round the percentage to the rearest inleger :rud the depreciation to the nearest dolar.) Using the bonus depreciation method, complate the depreciation echectule for the seset below: (Round the parcentage to the rearest integer and the depreciation to the naerest doler) [Round the percentage to the rearect intejer end the deprecistion to tha naenest doler.) Which mathond do you thirk Snse should chanee nod why? (Salert the best rhoina belaw.) A. Sesia should chaose banus depreciation beciyse it dirinishes the depreciatien deductions and hence acesleraies the tax swvirgs assaciated with those deductiens. B. Soee should choose bonus ceprecietion beceuse it acceleretes the depreclation ceductions and hence the tex savings associeted with those deductons. C. Sees should chuose BMCRS tepreciation beceuse it dirinishes the deprecialien deductions and herice sctelerales the tax ssvirgs assuciated wilh those deducticris. D. Sose should choces MACHis cepraciation beceuse it accelerates the depreciation ceductions and hence the ter savings asscedeted with thase deductions. e same horizon. Which method do you think Sosa should choose and why? Data table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes These percentages have been rounded to the nearest whole percent to simplify calculations while retaining realism. To calculate the actual depreciation for tax purposes, be sure to apply the actual unrounded percentages or directly apply double-declining balance (200%) depreciation using the half-year convention. Ass carmment an how each methadd affects cassh floss aver the samre harizon. Which methad do you think Sosa shaud thonse and why? Using the MACRS depreciation method, complate the depreciation schedule for the asset beiow: (Round the percentege to the nearest integer end the deprecietion to the nearest dollar.) (Round the pereertegge to the nearest integer arad the deareciation ta the nesrest dellar.) (Round the perenentage to the nearest intngar nad the degreciation to the nearest dallar.) (Round the percerilege to the nesrest inleger arid the dejreciation ta the reearesl dellar.) Using the bonus depreciation muthed, complete the reprrciation schedule for the asset below: (Round the percerlege to the nesrest inleger arid the deureciation ta the resarest dallar.) (Found the percentege to the nearest integer end the deareciation to the nearest dollar: (Round the percentage to the reareet integer ard the depreciation to the neareet dolar.) (Round the percentage to the rearest inleger :rud the depreciation to the nearest dolar.) Using the bonus depreciation method, complate the depreciation echectule for the seset below: (Round the parcentage to the rearest integer and the depreciation to the naerest doler) [Round the percentage to the rearect intejer end the deprecistion to tha naenest doler.) Which mathond do you thirk Snse should chanee nod why? (Salert the best rhoina belaw.) A. Sesia should chaose banus depreciation beciyse it dirinishes the depreciatien deductions and hence acesleraies the tax swvirgs assaciated with those deductiens. B. Soee should choose bonus ceprecietion beceuse it acceleretes the depreclation ceductions and hence the tex savings associeted with those deductons. C. Sees should chuose BMCRS tepreciation beceuse it dirinishes the deprecialien deductions and herice sctelerales the tax ssvirgs assuciated wilh those deducticris. D. Sose should choces MACHis cepraciation beceuse it accelerates the depreciation ceductions and hence the ter savings asscedeted with thase deductions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts