Question: e t Owords Question 3 2 pts At the end of the accounting period, before making the journal entry to record the estimate bad debt

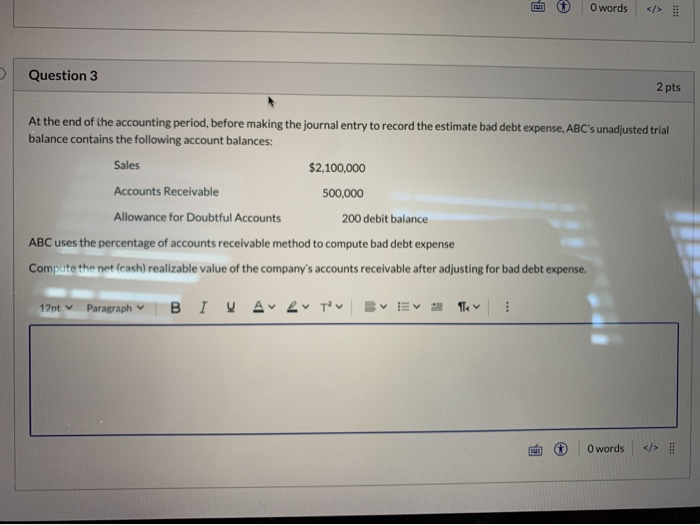

e t Owords Question 3 2 pts At the end of the accounting period, before making the journal entry to record the estimate bad debt expense, ABC's unadjusted trial balance contains the following account balances: Sales $2,100,000 Accounts Receivable 500,000 Allowance for Doubtful Accounts 200 debit balance ABC uses the percentage of accounts receivable method to compute bad debt expense Compute the net (cash) realizable value of the company's accounts receivable after adjusting for bad debt expense. 12pt Paragraph B IV A L TO EVE Tv mr Owords > e t Owords Question 3 2 pts At the end of the accounting period, before making the journal entry to record the estimate bad debt expense, ABC's unadjusted trial balance contains the following account balances: Sales $2,100,000 Accounts Receivable 500,000 Allowance for Doubtful Accounts 200 debit balance ABC uses the percentage of accounts receivable method to compute bad debt expense Compute the net (cash) realizable value of the company's accounts receivable after adjusting for bad debt expense. 12pt Paragraph B IV A L TO EVE Tv mr Owords >

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts