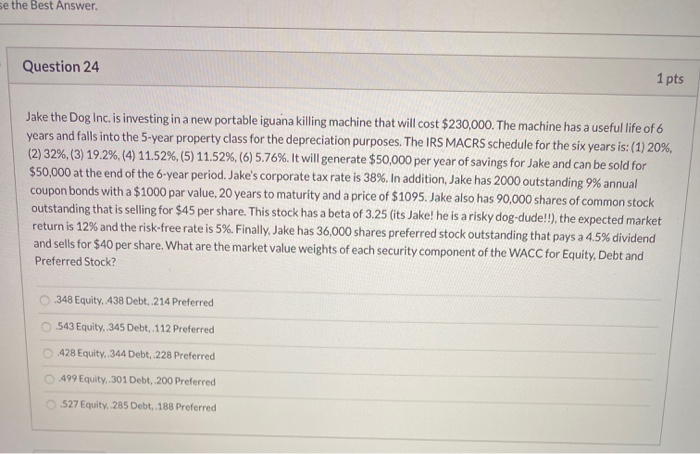

Question: e the Best Answer Question 24 1 pts Jake the Dog Inc. is investing in a new portable iguana killing machine that will cost $230,000.

e the Best Answer Question 24 1 pts Jake the Dog Inc. is investing in a new portable iguana killing machine that will cost $230,000. The machine has a useful life of 6 years and falls into the 5-year property class for the depreciation purposes. The IRS MACRS schedule for the six years is: (1) 20%, (2) 32%,(3) 19.2%, (4) 11.52%,(5) 11.52%, (6) 5.76%. It will generate $50,000 per year of savings for Jake and can be sold for $50,000 at the end of the 6-year period. Jake's corporate tax rate is 38%. In addition, Jake has 2000 outstanding 9% annual coupon bonds with a $1000 par value, 20 years to maturity and a price of $1095. Jake also has 90,000 shares of common stock outstanding that is selling for $45 per share. This stock has a beta of 3.25 (its Jake! he is a risky dog-dude!!), the expected market return is 12% and the risk-free rate is 5%. Finally, Jake has 36,000 shares preferred stock outstanding that pays a 4.5% dividend and sells for $40 per share. What are the market value weights of each security component of the WACC for Equity, Debt and Preferred Stock? 348 Equity, 438 Debt, 214 Preferred 543 Equity, 345 Debt, 112 Preferred 428 Equity, 344 Debt, 228 Preferred 499 Equity, 301 Debt, 200 Preferred 527 Equity, 285 Debt, 188 Preferred

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts