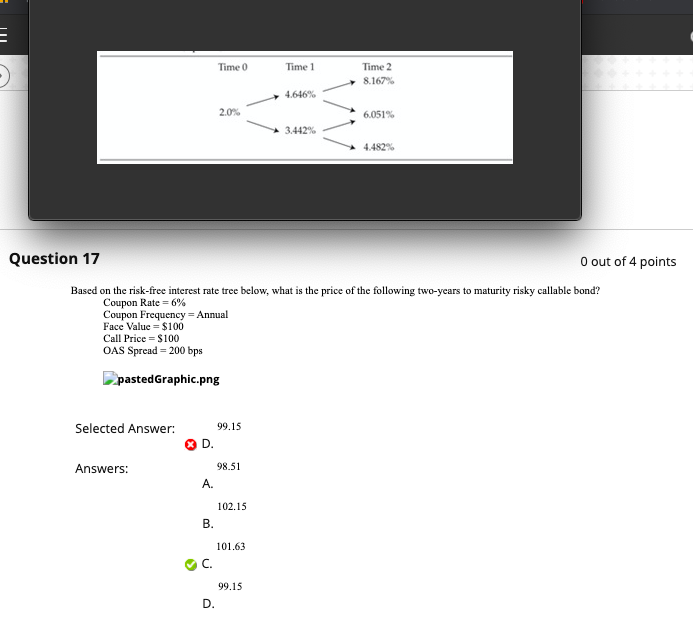

Question: E Time 0 Time 1 Time 2 8.167% 4.646% 2.0% 6,051% 3.442% M 4.482% Question 17 O out of 4 points Based on the risk-free

E Time 0 Time 1 Time 2 8.167% 4.646% 2.0% 6,051% 3.442% M 4.482% Question 17 O out of 4 points Based on the risk-free interest rate tree below, what is the price of the following two-years to maturity risky callable bond? Coupon Rate = 6% Coupon Frequency = Annual Face Value = $100 Call Price = $100 OAS Spread = 200 bps pastedGraphic.png Selected Answer: 99.15 D. Answers: 98.51 A. 102.15 B. 101.63 99.15 D

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock