Question: E) Two years ago you signed a five-year Interest Rate Swap Recelving Fixed rate at 9%. Of course, you are paying LIBOR flat. Assume that

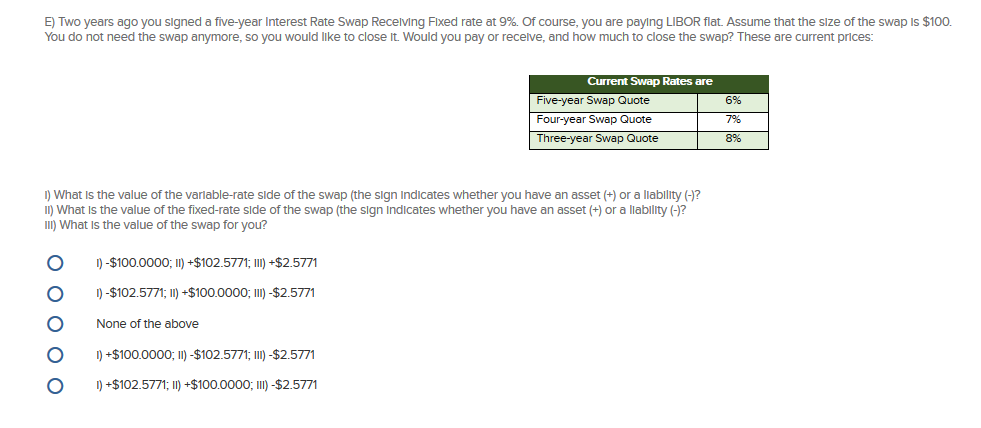

E) Two years ago you signed a five-year Interest Rate Swap Recelving Fixed rate at 9%. Of course, you are paying LIBOR flat. Assume that the size of the swap is $100. You do not need the swap anymore, so you would like to close it. Would you pay or receive, and how much to close the swap? These are current prices: 6% Current Swap Rates are Five-year Swap Quote Four-year Swap Quote Three-year Swap Quote 7% 8% 1) What is the value of the variable-rate side of the swap (the sign Indicates whether you have an asset (+) or a liability (-)? II) What is the value of the fixed-rate side of the swap (the sign Indicates whether you have an asset (+) or a liability (-)? III) What is the value of the swap for you? 1)-$100.0000; II) +$102.5771; III) +$2.5771 O ) -$102.5771; 11) $100.0000; II) -$2.5771 None of the above 1) +$100.0000; 11) - $102.5771; 11)-$2.5771 1) +$102.5771; 11)+$100.0000; II) - $2.5771 E) Two years ago you signed a five-year Interest Rate Swap Recelving Fixed rate at 9%. Of course, you are paying LIBOR flat. Assume that the size of the swap is $100. You do not need the swap anymore, so you would like to close it. Would you pay or receive, and how much to close the swap? These are current prices: 6% Current Swap Rates are Five-year Swap Quote Four-year Swap Quote Three-year Swap Quote 7% 8% 1) What is the value of the variable-rate side of the swap (the sign Indicates whether you have an asset (+) or a liability (-)? II) What is the value of the fixed-rate side of the swap (the sign Indicates whether you have an asset (+) or a liability (-)? III) What is the value of the swap for you? 1)-$100.0000; II) +$102.5771; III) +$2.5771 O ) -$102.5771; 11) $100.0000; II) -$2.5771 None of the above 1) +$100.0000; 11) - $102.5771; 11)-$2.5771 1) +$102.5771; 11)+$100.0000; II) - $2.5771

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts