Question: e. Using the 180-day forward exchange information from Table 19-3, calculate the return on 1-year securities in Switzerland assuming the rate of return on 1-year

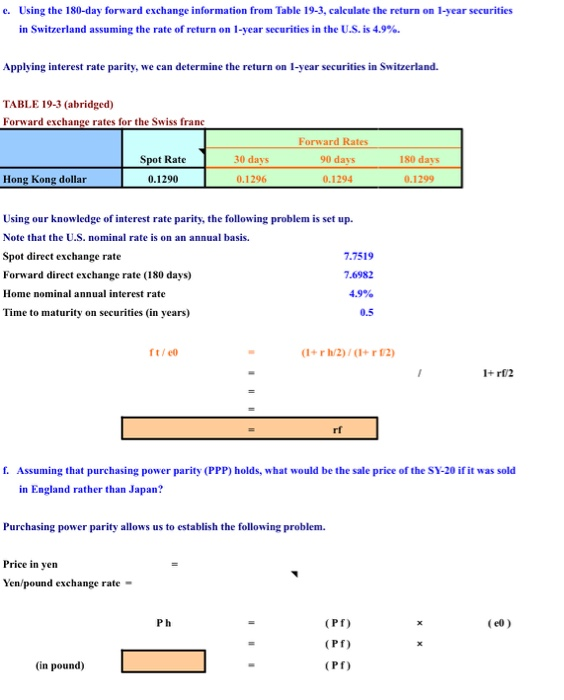

e. Using the 180-day forward exchange information from Table 19-3, calculate the return on 1-year securities in Switzerland assuming the rate of return on 1-year securities in the U.S.is 4.9% Applying interest rate parity, we can determine the return on 1-year securities in Switzerland. TABLE 19-3 (abridged) Forward exchange rates for the Swiss franc Spot Rate 0.1290 30 days 0.1296 Forward Rates 90 days 0.1294 180 days 0.1299 Hong Kong dollar Using our knowledge of interest rate parity, the following problem is set up. Note that the U.S. nominal rate is on an annual basis. Spot direct exchange rate 7.7519 Forward direct exchange rate (180 days) 7.6982 Home nominal annual interest rate 4.9% Time to maturity on securities (in years) 0.5 ful (1+rh/2)/(1+ 12) 1+rf/2 1. Assuming that purchasing power parity (PPP) holds, what would be the sale price of the SY-20 if it was sold in England rather than Japan? Purchasing power parity allows us to establish the following problem. Price in yen Yen/pound exchange rate- (PT) (0) (PF) (in pound) (PO) e. Using the 180-day forward exchange information from Table 19-3, calculate the return on 1-year securities in Switzerland assuming the rate of return on 1-year securities in the U.S.is 4.9% Applying interest rate parity, we can determine the return on 1-year securities in Switzerland. TABLE 19-3 (abridged) Forward exchange rates for the Swiss franc Spot Rate 0.1290 30 days 0.1296 Forward Rates 90 days 0.1294 180 days 0.1299 Hong Kong dollar Using our knowledge of interest rate parity, the following problem is set up. Note that the U.S. nominal rate is on an annual basis. Spot direct exchange rate 7.7519 Forward direct exchange rate (180 days) 7.6982 Home nominal annual interest rate 4.9% Time to maturity on securities (in years) 0.5 ful (1+rh/2)/(1+ 12) 1+rf/2 1. Assuming that purchasing power parity (PPP) holds, what would be the sale price of the SY-20 if it was sold in England rather than Japan? Purchasing power parity allows us to establish the following problem. Price in yen Yen/pound exchange rate- (PT) (0) (PF) (in pound) (PO)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts