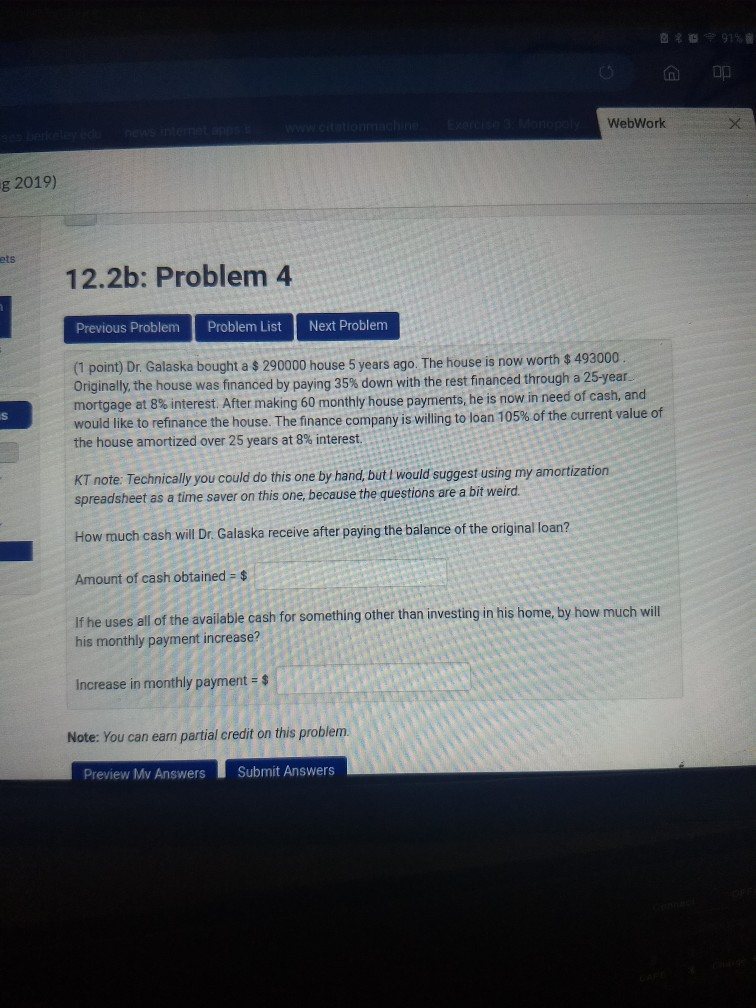

Question: e WebWork g 2019) 12.2b: Problem 4 Previous Problem Problem List Next Problem (1 point) Dr. Galaska bought a $ 290000 house 5 years ago.

e

WebWork g 2019) 12.2b: Problem 4 Previous Problem Problem List Next Problem (1 point) Dr. Galaska bought a $ 290000 house 5 years ago. The house is now worth $ 493000 Originally the house was financed by paying 35%down with the rest financed through a 25-year- mortgage at 8% interest. After making 60 monthly house payments, he is now in need of cash, and would like to refinance the house. The finance company is willing to loan 105% of the current value of the house amortized over 25 years at 8% interest. KT note Technically you could do this one by hand, but ! would suggest using my amortization spreadsheet as a time saver on this one, because the questions are a bit weird. How much cash will Dr. Galaska receive after paying the balance of the original loan? Amount of cash obtained $ If he uses all of the available cash for something other than investing in his home, by how much wil his monthly payment increase? Increase in monthly payment s Note: You can earn partial credit on this problem Preview Mv AnswersSubmit Answers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts