Question: E ) Year - end adjusting entry to record bad debt expense Assuming the company uses the balance sheet approach to estimating uncollectibles, determine the:

EYearend adjusting entry to record bad debt expense

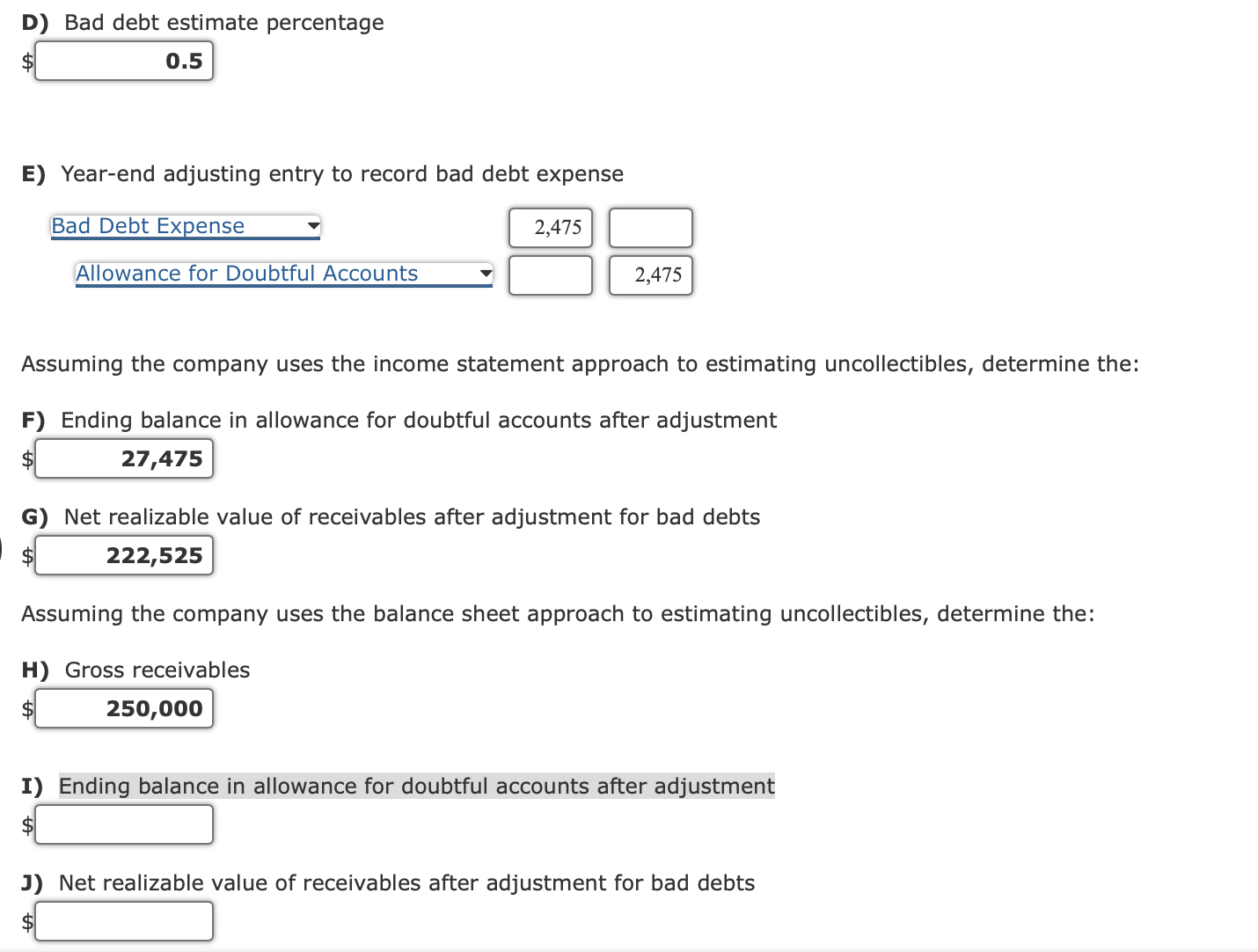

Assuming the company uses the balance sheet approach to estimating uncollectibles, determine the:

IEnding balance in allowance for doubtful accounts after adjustment

JNet realizable value of receivables after adjustment for bad debts The following information was taken from the records of Alphabet Soup for the year ended December :

Determine the following:

A Gross sales

$

B Net sales

$

C Gross profit

ddagger

Assuming the company uses the income statement approach to estimating uncollectibles, determine the

D Bad debt estimate percentage

$ D Bad debt estimate percentage

$

E Yearend adjusting entry to record bad debt expense

Bad Debt Expense

Assuming the company uses the income statement approach to estimating uncollectibles, determine the:

F Ending balance in allowance for doubtful accounts after adjustment

$

G Net realizable value of receivables after adjustment for bad debts

s

Assuming the company uses the balance sheet approach to estimating uncollectibles, determine the:

H Gross receivables

s

I Ending balance in allowance for doubtful accounts after adjustment

ddagger

J Net realizable value of receivables after adjustment for bad debts

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock