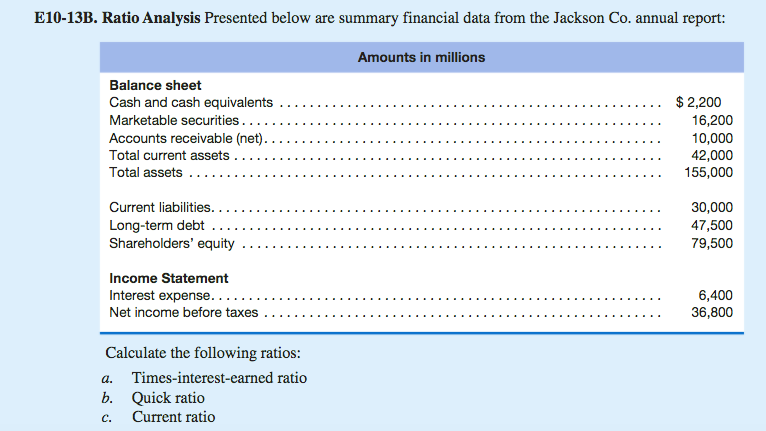

Question: E10-13B. Ratio Analysis Presented below are summary financial data from the Jackson Co. annual report: Amounts in millions Balance sheet Cash and cash equivalents .

E10-13B. Ratio Analysis Presented below are summary financial data from the Jackson Co. annual report: Amounts in millions Balance sheet Cash and cash equivalents . . . . . . . .. . . . . . . . . . . . . . . . . . . . . . .. . . . . . . . . .. . . . . . . 2,200 Total assets 155,000 ....30,000 Shareholders' equity .. Income Statement Interest expense. Net income before taxes . . . . 6,400 36,800 .. . . .. . . . . . . .. . . . .. . . . . . .. . . . . . . . . . . . . . . . . . .. Calculate the following ratios: a. Times-interest-earned ratio b. Quick ratio c. Current ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts