Question: E10-15 Preparing a Debt Payment Schedule with the Effective-Interest Method of Amortization, and Determining Reported Amounts LO10-3 Shuttle Company issued $900,000, three year, 10 percent

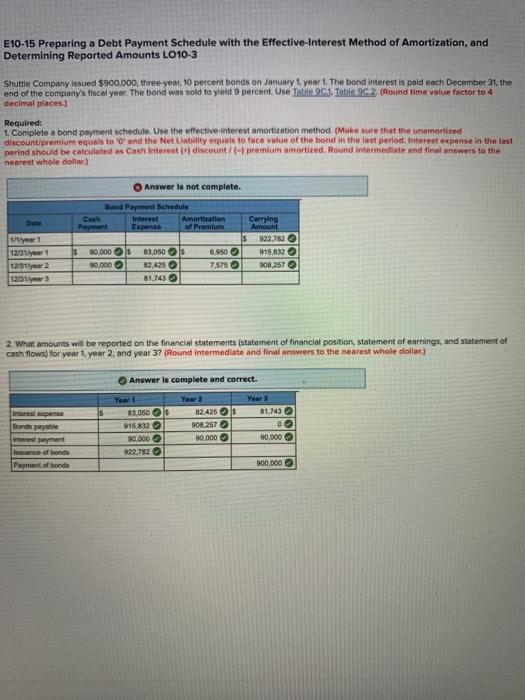

E10-15 Preparing a Debt Payment Schedule with the Effective-Interest Method of Amortization, and Determining Reported Amounts LO10-3 Shuttle Company issued $900,000, three year, 10 percent bonds on January 1 year 1. The bond interest is paid each December 31, the end of the company's fiscal year. The bond was sold to yield 9 percent. Use Table 96.1 Table 9.2. Round time value factor to 4 decimal places.) Required: 1. Complete a bond payment schedule. Use the effective interest amortization method. (Make sure that the namortired discount premium equals to 'O' and the Net Liability equal to face value of the bond in the last period. Interest expense in the last period should be calculated us Cash Interest discount/premium amortired. Round Intermediate and final answers to the nearest whole dollar) Answer is not complete. Bond Payment Schedule Internet Amortization Payment Eapens of Premium Bate Carrying Amount 1$ 922,762 9:5,832 108,257 is yer 1 1231 year 1292 12 years 0.000 83,050 $ 82425 81.743 6.960 7,575 OOO 0.000 2. What amounts will be reported on the financial statements statement of financial position statement of earnings, and statement of cash flows for year 1 year 2, and year 37 (Round intermediate and final answers to the nearest whole dollar) Answer is complete and correct. Year 2 82425 Year a 81,743 IS Interesterende Bonds payable Years 89050 016832 90.000 922,782 908.257 90,000 OOO O 90.000 Ide of bonds Payment of bonde 900,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts