Question: E10-2 Determining Financial Statement Effects for Long-Term Note and First Interest Payment, with Discount LO10-1, 10-3, 10-7 Grocery Corporation sold $500,000,9 percent notes on January

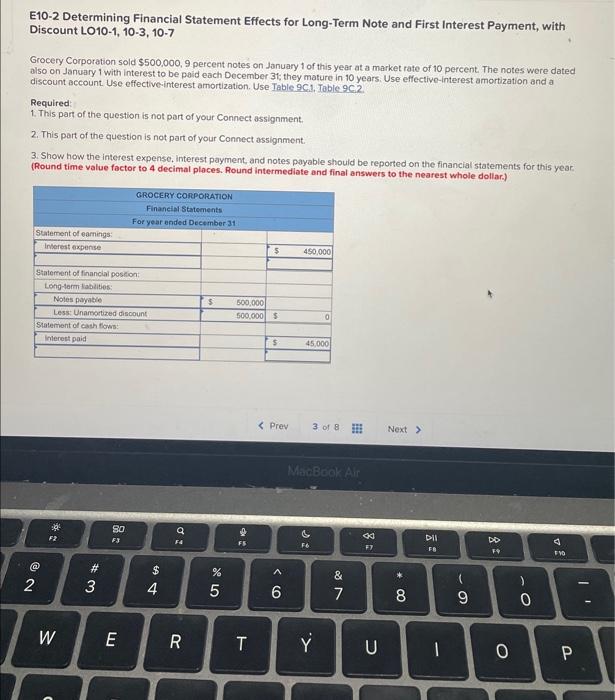

E10-2 Determining Financial Statement Effects for Long-Term Note and First Interest Payment, with Discount LO10-1, 10-3, 10-7 Grocery Corporation sold $500,000,9 percent notes on January 1 of this year at a market rate of 10 percent. The notes were dated also on January 1 with interest to be paid each December 31; they mature in 10 years. Use effective-interest amortization and a discount account. Use effective interest amortization. Use Table 9C1, Table 9C22 Required: 1. This part of the question is not part of your Connect assignment. 2. This part of the question is not part of your Connect assignment. 3. Show how the interest expense, interest payment, and notes payable should be reported on the financial statements for this year. (Round time value factor to 4 decimal ploces. Round intermedlate and final answers to the nearest whole dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts