Question: E10-3 Using variable costing and absorption costing The chief executive officer of Acadia, Inc. attended a conference in which one of the sessions was devoted

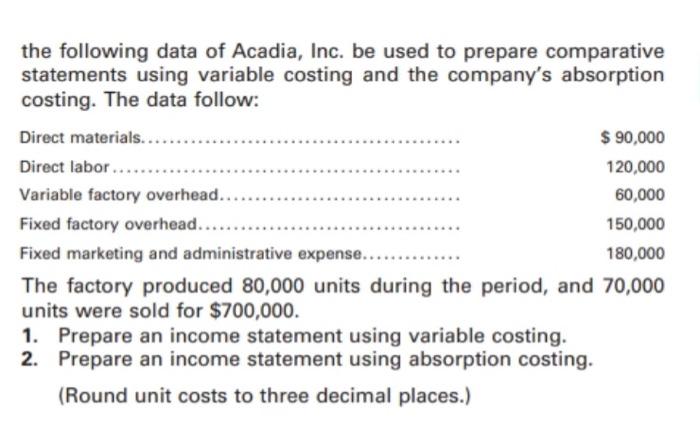

E10-3 Using variable costing and absorption costing The chief executive officer of Acadia, Inc. attended a conference in which one of the sessions was devoted to variable costing. The CEO was impressed by the presentation and has asked that the following data of Acadia, Inc. be used to prepare comparative statements using variable costing and the company's absorption costing. The data follow: Direct materials.... $ 90,000 Direct labor..... 120,000 60,000 Variable factory overhead... Fixed factory overhead. 150,000 Fixed marketing and administrative expense... 180,000 The factory produced 80,000 units during the period, and 70,000 units were sold for $700,000. 1. Prepare an income statement using variable costing. 2. Prepare an income statement using absorption costing. (Round unit costs to three decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts