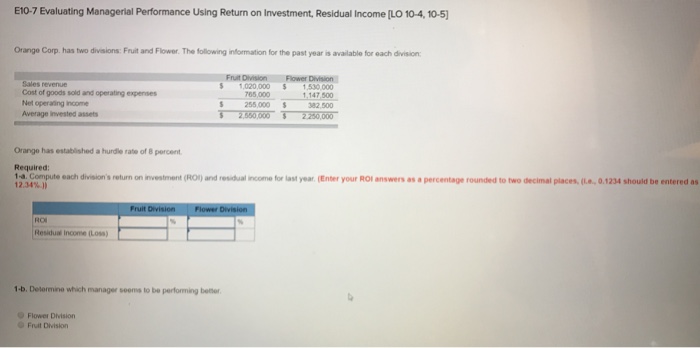

Question: E10-7 Evaluating Managerial Performance Using Return on Investment, Residual Income /LO 10-4, 10-5 Orange Corp. has two divisions: Fruit and Flower. The following information for

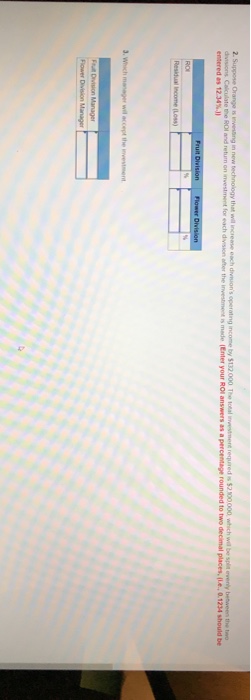

E10-7 Evaluating Managerial Performance Using Return on Investment, Residual Income /LO 10-4, 10-5 Orange Corp. has two divisions: Fruit and Flower. The following information for the past year is available for each division Sales revenue Cost of goods sold and operating expenses Net operaing income Average invested assets 1,020,000 $ 1530 000 765,000 255,000 1.147 500 382,500 2,550 0002 250,000 Orange has established a hurdle rate of 8 percent Required: 1a Compute each di Sion s return on n vest 12.34%), ent (RO) and res du. rccene for last year. Enter your ROanswers as a percentage rounded to two decimal places La 0.1234 should be entered as Resilua Income tLoss) 1-b. Determine which manager soems to be performing betor Flower Division Fruit Division

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts