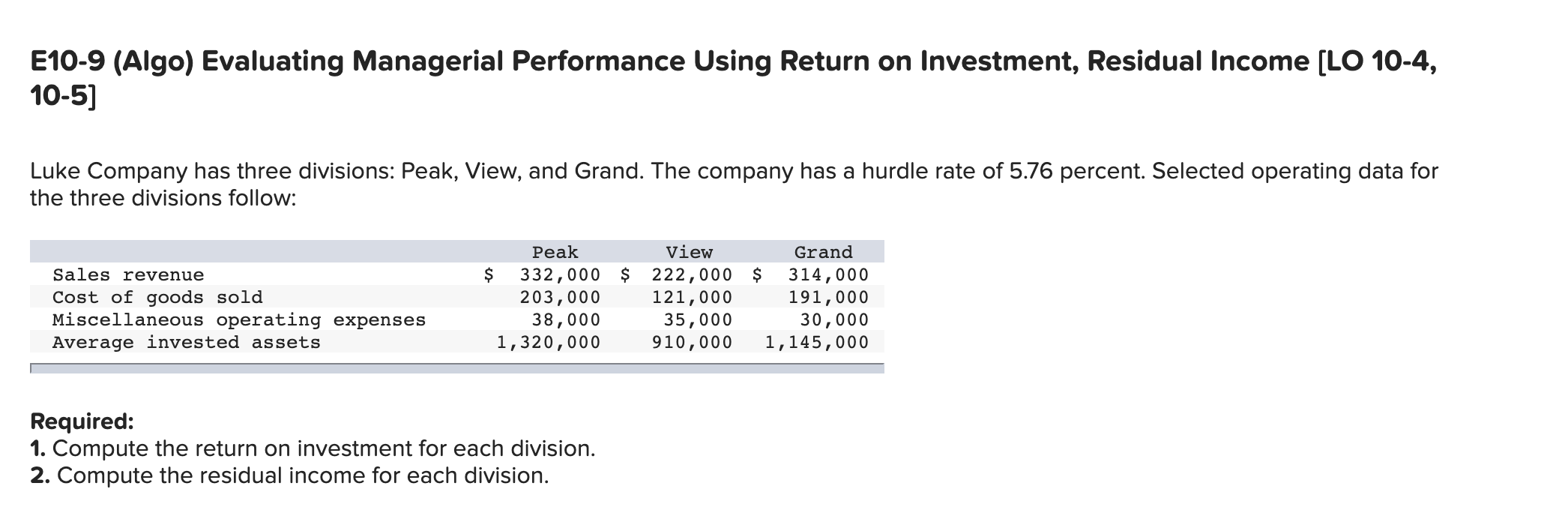

Question: E10-9 (Algo) Evaluating Managerial Performance Using Return on Investment, Residual Income (LO 10-4, 10-5] Luke Company has three divisions: Peak, View, and Grand. The company

![(LO 10-4, 10-5] Luke Company has three divisions: Peak, View, and Grand.](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e85a91f2182_56966e85a9196f62.jpg)

E10-9 (Algo) Evaluating Managerial Performance Using Return on Investment, Residual Income (LO 10-4, 10-5] Luke Company has three divisions: Peak, View, and Grand. The company has a hurdle rate of 5.76 percent. Selected operating data for the three divisions follow: $ Sales revenue Cost of goods sold Miscellaneous operating expenses Average invested assets Peak View Grand 332,000 $ 222,000 $ 314,000 203,000 121,000 191,000 38,000 35,000 30,000 1,320,000 910,000 1,145,000 Required: 1. Compute the return on investment for each division. 2. Compute the residual income for each division. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the return on investment for each division. (Enter your ROI answers as a percentage rounded to two decimal places, (i.e., 0.1234 should be entered as 12.34%.)) Peak View Grand Return on Investment Required 1 Required 2 > Required: 1. Compute the return on investment for each division. 2. Compute the residual income for each division. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the residual income for each division. (Loss amounts should be indicated by a minus sign. Do not round intermediate calculations. Round your answers to nearest whole dollar.) Peak View Grand Residual Income (Loss)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts