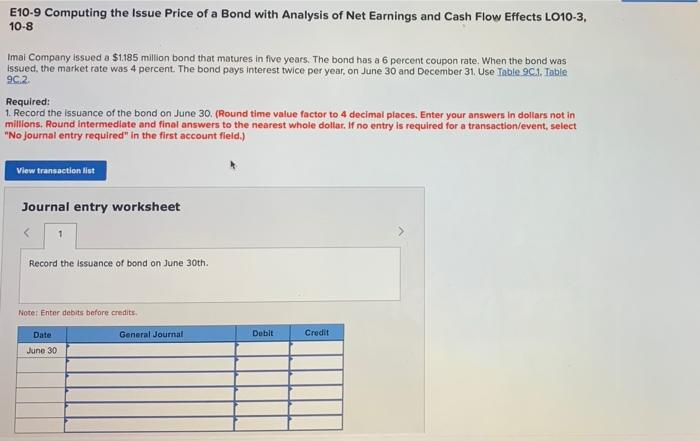

Question: E10-9 Computing the Issue Price of a Bond with Analysis of Net Earnings and Cash Flow Effects LO10-3, 10-8 Imal Company issued a $1.185 million

E10-9 Computing the Issue Price of a Bond with Analysis of Net Earnings and Cash Flow Effects LO10-3, 10-8 Imal Company issued a $1.185 million bond that matures in five years. The bond has a 6 percent coupon rate. When the bond was issued, the market rate was 4 percent. The bond pays interest twice per year, on June 30 and December 31. Use Table 9.1. Table 90.2 Required: 1. Record the issuance of the bond on June 30 (Round time value factor to 4 decimal places. Enter your answers in dollars not in millions. Round Intermediate and final answers to the nearest whole dollar. If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Record the issuance of bond on June 30th. Noter Enter debits before credits General Journal Debit Credit Date June 30 2. Was the bond issued at a discount or at a premium? Discount Premium

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts