Question: E11-10 (Algo) Computing Dividends on Preferred Stock and Analyzing Differences [LO 11-3, LO 11-4] The records of Alvarez Incorporated reflected the following balances in

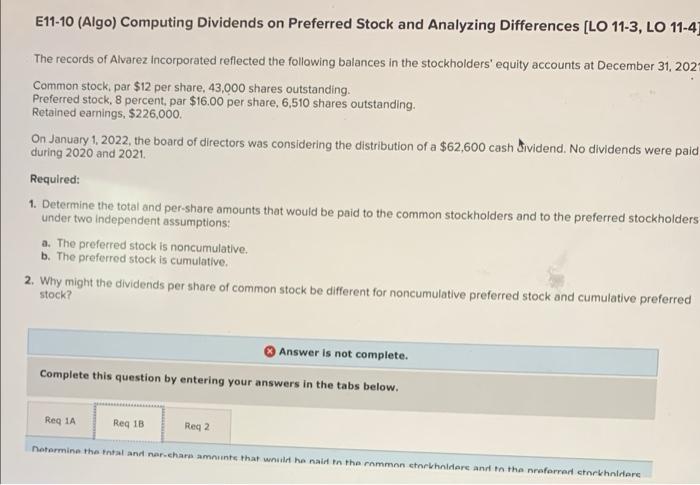

E11-10 (Algo) Computing Dividends on Preferred Stock and Analyzing Differences [LO 11-3, LO 11-4] The records of Alvarez Incorporated reflected the following balances in the stockholders' equity accounts at December 31, 2021 Common stock, par $12 per share, 43,000 shares outstanding. Preferred stock, 8 percent, par $16.00 per share, 6,510 shares outstanding. Retained earnings, $226,000. On January 1, 2022, the board of directors was considering the distribution of a $62,600 cash dividend. No dividends were paid during 2020 and 2021. Required: 1. Determine the total and per-share amounts that would be paid to the common stockholders and to the preferred stockholders under two independent assumptions: a. The preferred stock is noncumulative. b. The preferred stock is cumulative. 2. Why might the dividends per share of common stock be different for noncumulative preferred stock and cumulative preferred stock? Answer is not complete. Complete this question by entering your answers in the tabs below. Req 1A Req 1B Req 2 Determine the tntal and nar-chara amnunts that would he naid in the common stockholders and to the nreferred stockholders

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts