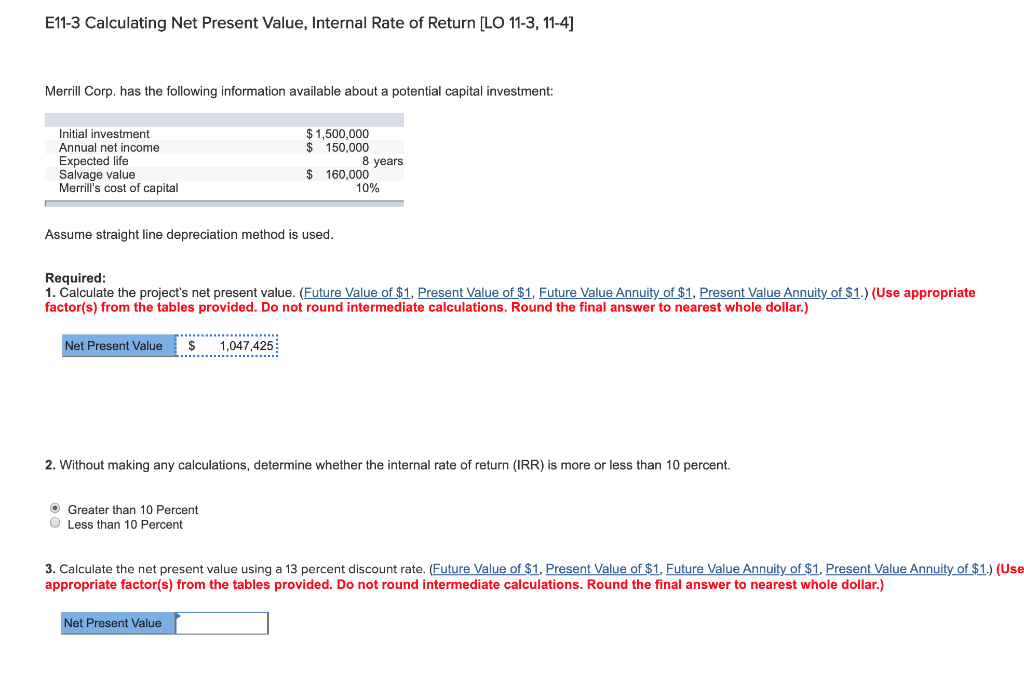

Question: E11-3 Calculating Net Present Value, Internal Rate of Return [LO 11-3, 11-4] Merrill Corp. has the following information available about a potential capital investment: Initial

E11-3 Calculating Net Present Value, Internal Rate of Return [LO 11-3, 11-4] Merrill Corp. has the following information available about a potential capital investment: Initial investment Annual net income Expected life Salvage value Merrill's cost of capital $1,500,000 $ 150,000 8 years $ 160,000 10% Assume straight line depreciation method is used. Required: 1. Calculate the project's net present value. (Future Value of $1, Present Value of $1. Future Value Annuity of $1, Present Value Annuity of $1.) (Use appropriate factor(s) from the tables provided. Do not round intermediate calculations. Round the final answer to nearest whole dollar.) Net Present Value $ 1,047,425 2. Without making any calculations, determine whether the internal rate of return (IRR) is more or less than 10 percent. O Greater than 10 Percent Less than 10 Percent 3. Calculate the net present value using a 13 percent discount rate. (Future Value of $1, Present Value of $1, Future Value Annuity of $1, Present Value Annuity of $1.) (Use appropriate factor(s) from the tables provided. Do not round intermediate calculations. Round the final answer to nearest whole dollar.) Net Present Value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts