Question: E11-6 (Algo) Comparing Options Using Present Value Concepts [LO 11-S1] After hearing a knock at your front door, you are surprised to see the

![E11-6 (Algo) Comparing Options Using Present Value Concepts [LO 11-S1] After hearing](https://s3.amazonaws.com/si.experts.images/answers/2024/05/6657a6bbd15fa_3476657a6bbca7a1.jpg)

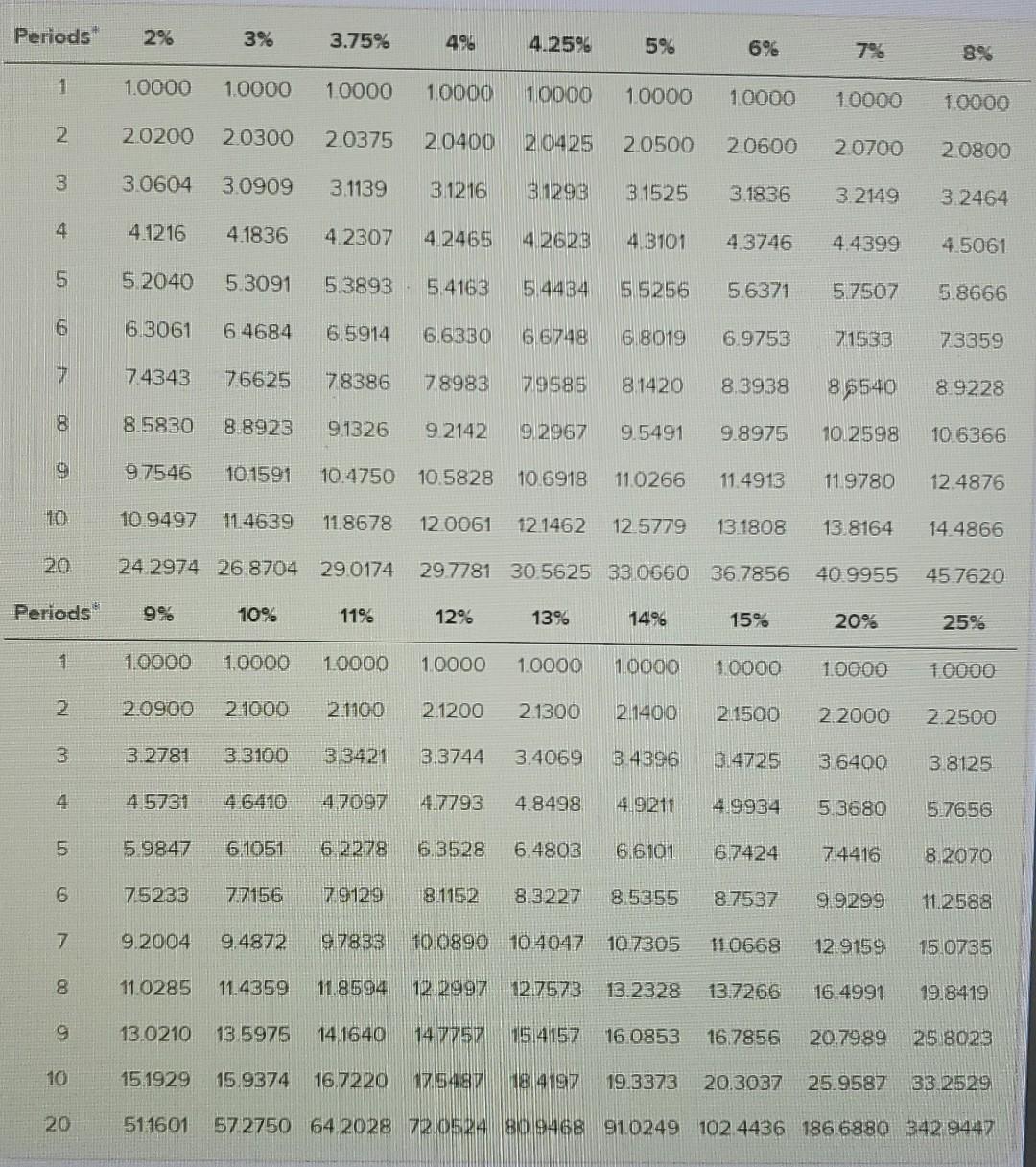

E11-6 (Algo) Comparing Options Using Present Value Concepts [LO 11-S1] After hearing a knock at your front door, you are surprised to see the Prize Patrol from a large, well-known magazine subscription company. It has arrived with the good news that you are the big winner, having won $21 million. You have three options. (a) Receive $1.05 million per year for the next 20 years. (b) Have $8.25 million today. (c) Have $2.25 million today and receive $750,000 for each of the next 20 years. Your financial adviser tells you that it is reasonable to expect to earn 13 percent on investments. Required: 1. Calculate the present value of each option. (Future Value of $1, Present Value of $1, Future Value Annuity of $1, Present Value Annuity of $1.) (Use appropriate factor(s) from the tables provided. Round your final answer to the nearest whole dollar. Enter your answers in dollars, not in millions.) Option A Option B T Option C Present Value 2. Determine which option you prefer. O Option C O Option A Option B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts