Question: E12-9 Reporting and Interpreting Cash Flows from Operating Activities from an Analyst's Perspective (Indirect Method) L012-2 Time Warner Inc. is a leading media and entertainment

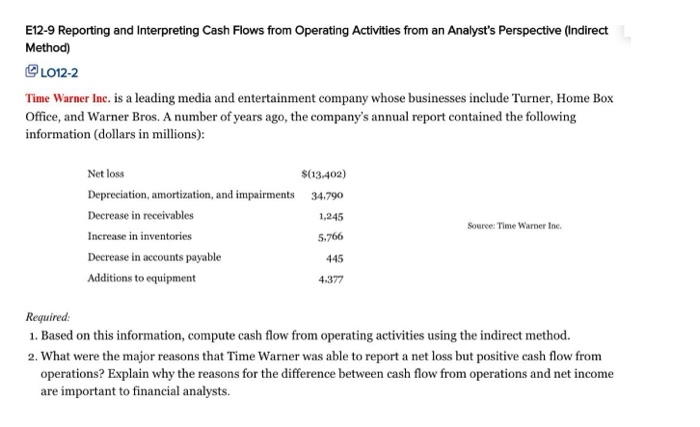

E12-9 Reporting and Interpreting Cash Flows from Operating Activities from an Analyst's Perspective (Indirect Method) L012-2 Time Warner Inc. is a leading media and entertainment company whose businesses include Turner, Home Box Office, and Warner Bros. A number of years ago, the company's annual report contained the following information (dollars in millions): Net loss $(13.402) Depreciation, amortization, and impairments 34.790 Decrease in receivables 1,245 Increase in inventories Decrease in accounts payable Additions to equipment 4.377 Source: Time Warner Inc 5.766 445 Required: 1. Based on this information, compute cash flow from operating activities using the indirect method. 2. What were the major reasons that Time Warner was able to report a net loss but positive cash flow from operations? Explain why the reasons for the difference between cash flow from operations and net income are important to financial analysts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts