Question: E13-2A. Journalize, record, and post when appropriate the following transactions into the sales journal (same headings as exercise E13-1A) and general journal (page 1). All

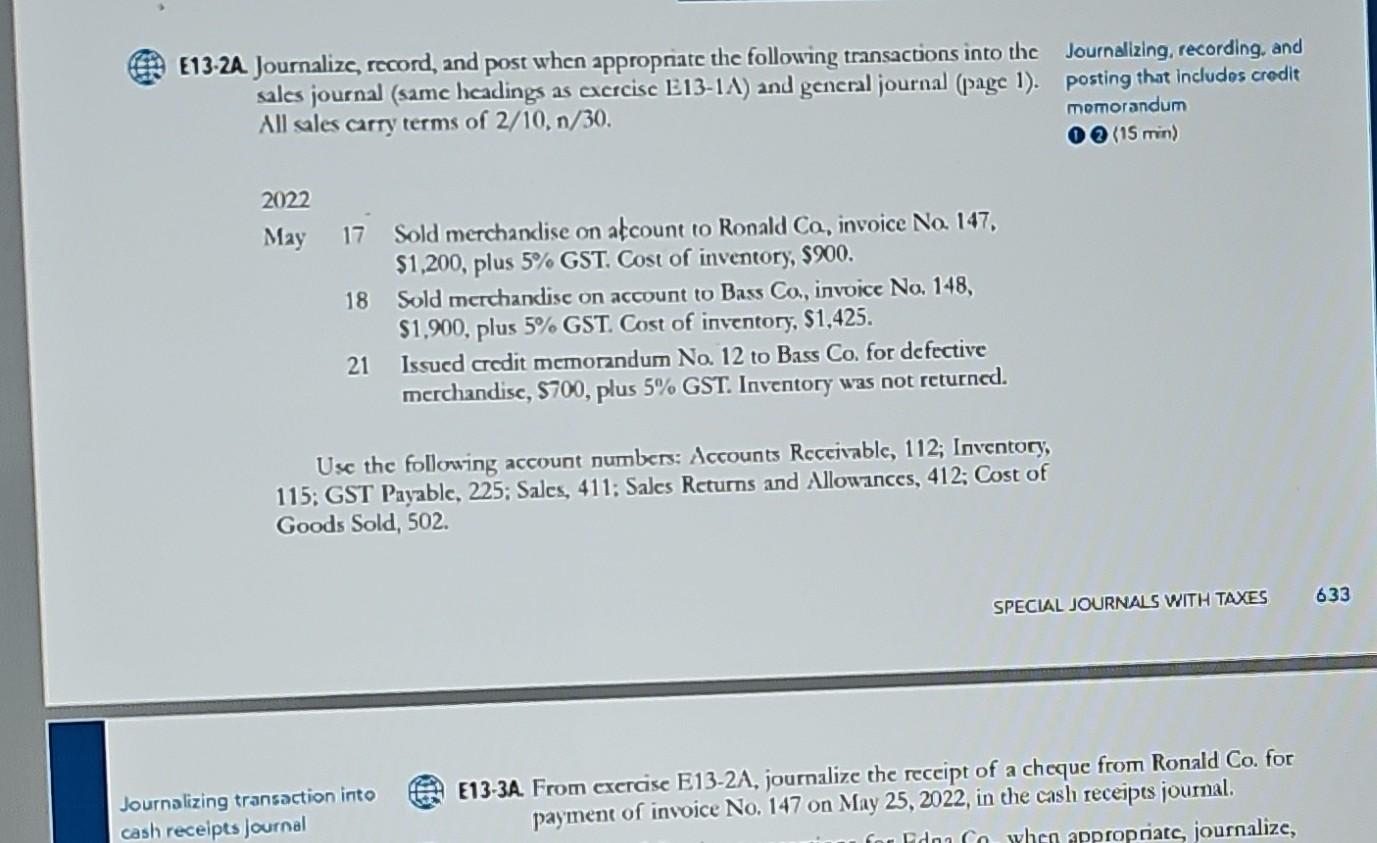

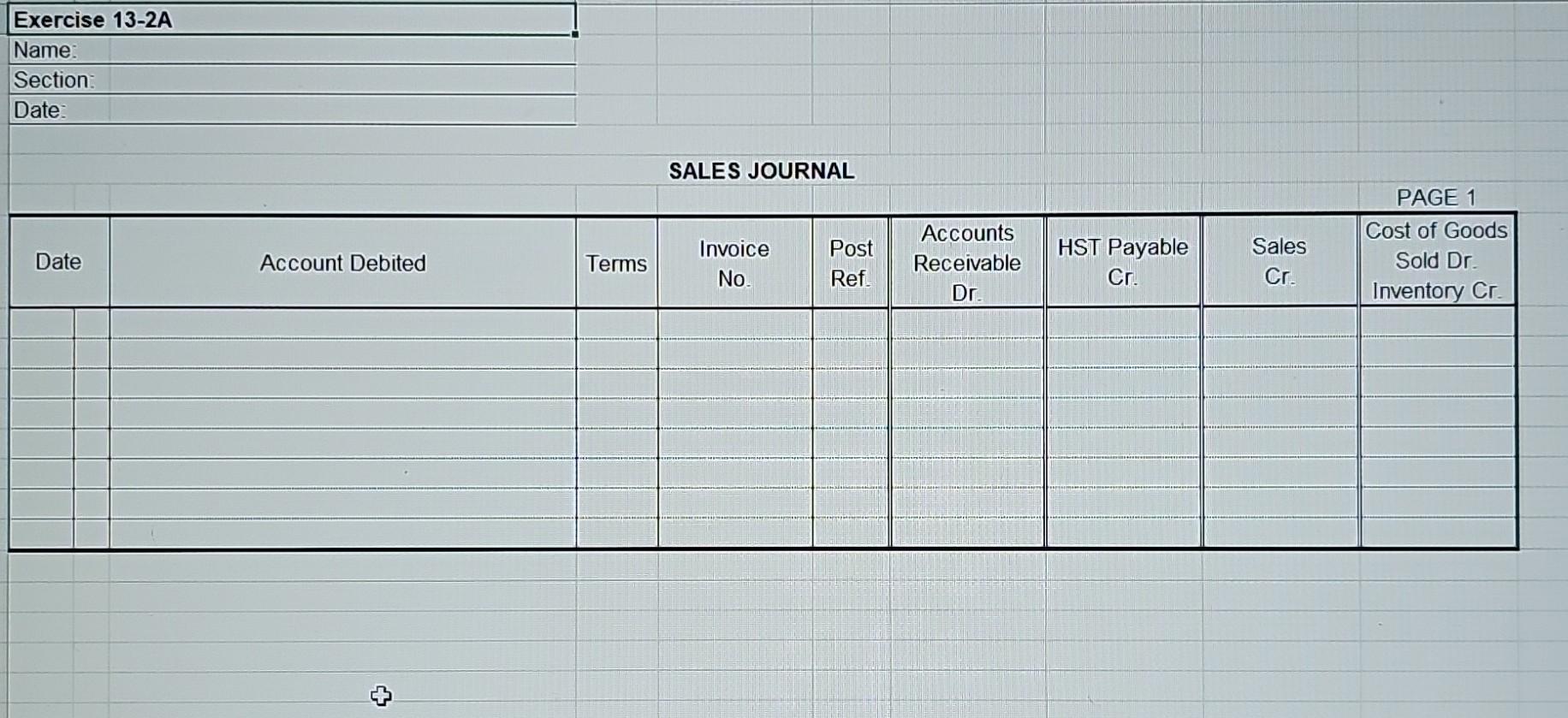

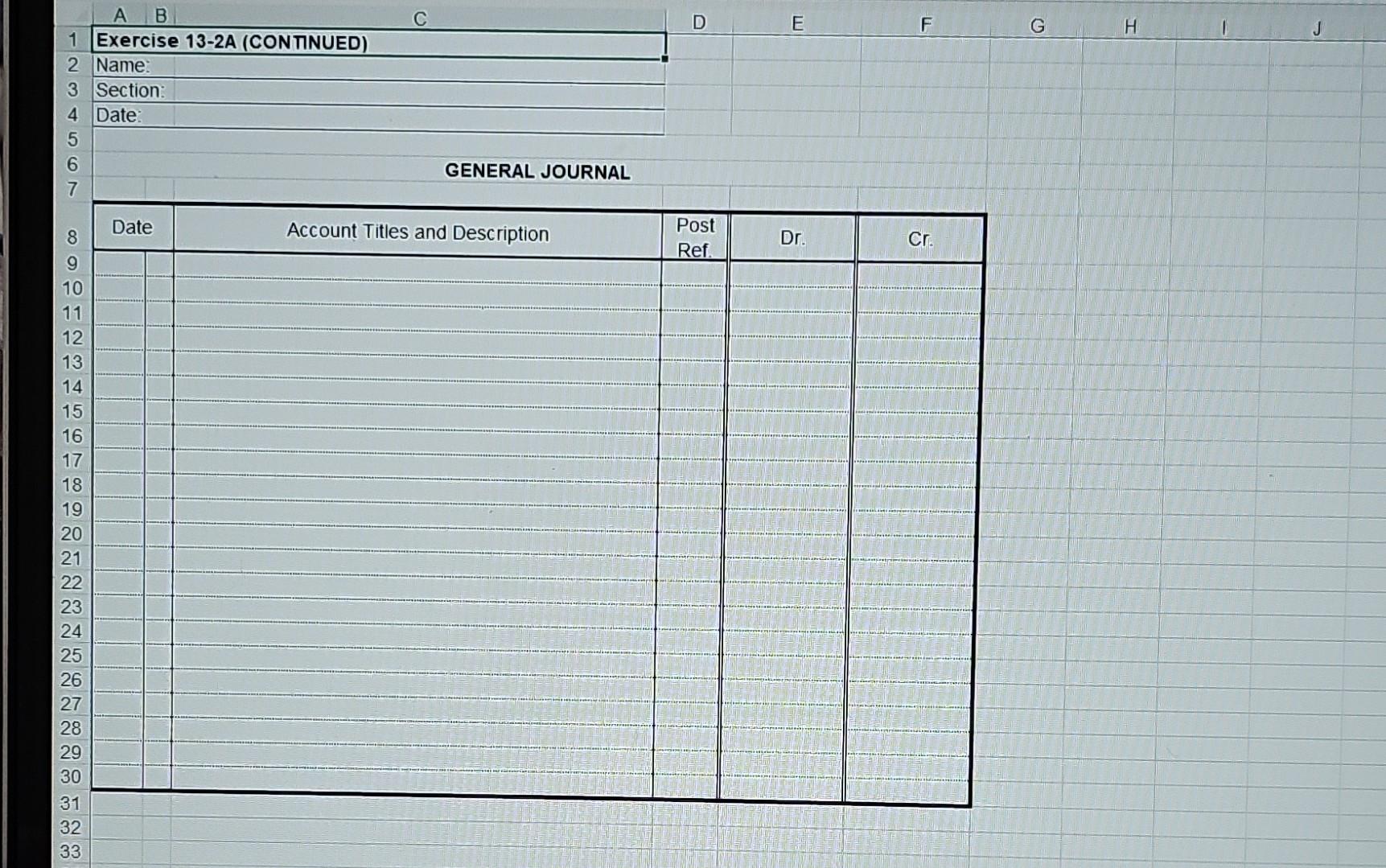

E13-2A. Journalize, record, and post when appropriate the following transactions into the sales journal (same headings as exercise E13-1A) and general journal (page 1). All sales carry terms of 2/10, n/30. 2022 May 17 Sold merchandise on account to Ronald Co, invoice No. 147, $1,200, plus 5% GST. Cost of inventory, $900. 18 Sold merchandise on account to Bass Co., invoice No. 148, $1,900, plus 5% GST. Cost of inventory, $1,425. 21 Issued credit memorandum No. 12 to Bass Co. for defective merchandise, $700, plus 5% GST. Inventory was not returned. Use the following account numbers: Accounts Receivable, 112, Inventory, 115: GST Payable, 225; Sales, 411; Sales Returns and Allowances, 412; Cost of Goods Sold, 502. Journalizing transaction into cash receipts journal Journalizing, recording, and posting that includes credit memorandum

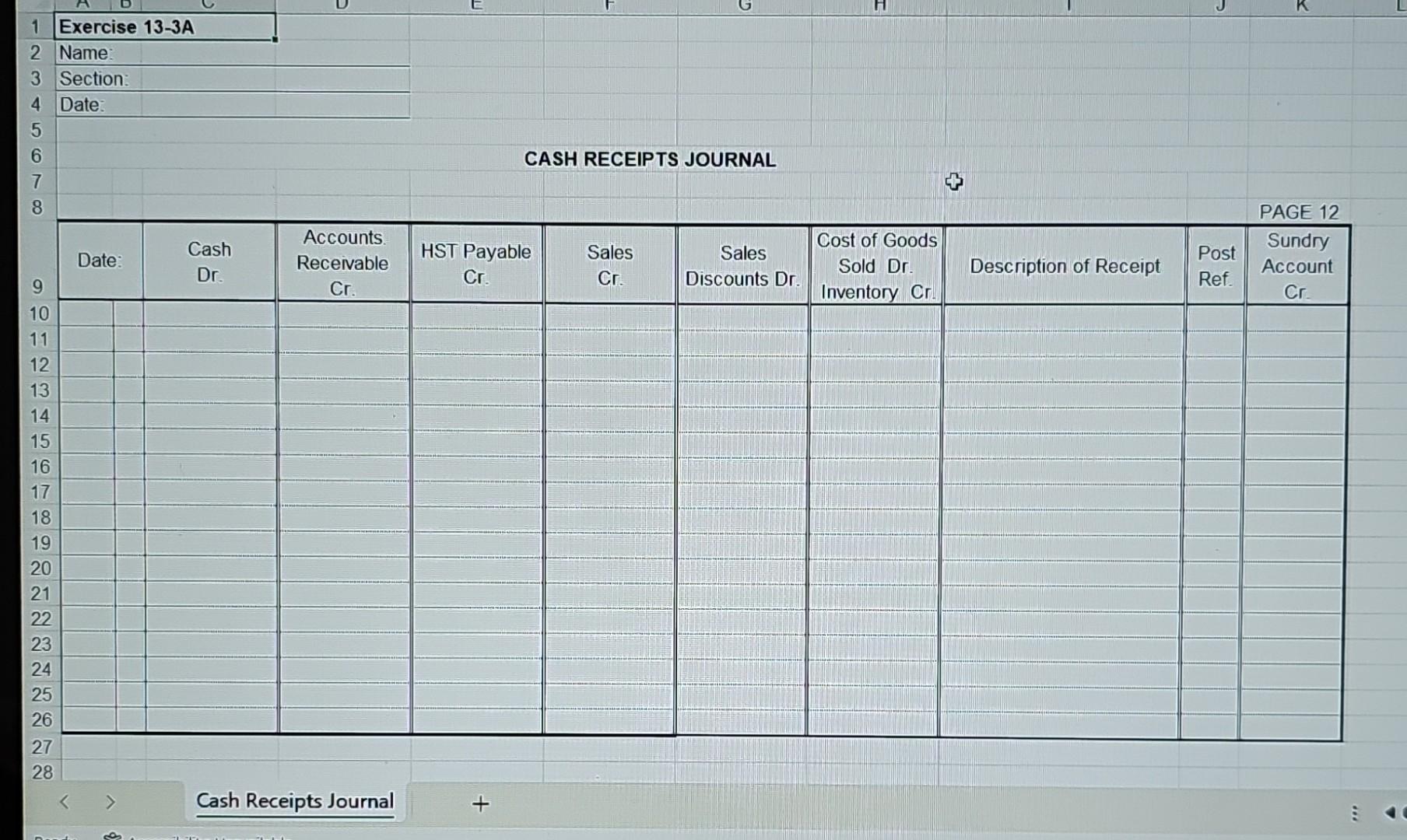

E13-2A. Journalize, record, and post when appropnate the following transactions into the Journalizing, recording. and sales journal (same headings as excrcise E13-1 ) and general journal (page 1). posting that includos credit All ales carry terms of 2/10,n/30. momorandum (1)2(15min) 2022 May 17 Sold merchandise on akcount to Ronald Ca, invoice No. 147. $1,200, plus 5% GST. Cost of inventory, $900. 18 Sold merchandise on account to Bass Co, invoice No,148, $1,900, plus 5\% GST. Cost of inventory, \$1,425. 21 Issued credit memorandum Na. 12 to Bass Co. for defective merchandise, 5700 , plus 5% GST. Inventory was not returned. Use the following account numbers: Accounts Reccivable, 112; Inventory, 115; GST Payable, 225; Sales, 411: Sales Returns and Allowances, 412; Cost of Goods Sold, 502. SPECLAL JOURNALS WITH TAXES Journalizing transaction into E13-3A. From exercise E13-2A, journalize the receipt of a cheque from Ronald Co. for cash receipts journal payment of invoice No. 147 on May 25, 2022, in the ansh receipts journal. SALES JOURNAL GENERAL JOURNAL Sales Returns \& Allowances 41 c Eost of Goods Sold 502 Journalizing transaction into E13-3A. From exercise E13-2A, journalize the receipt of a cheque from Ronald Co. for cash recelpes journal payment of invoice No. 147 on May 25, 2022, in the cash receipts journal. CASH RECEIPTS JOURNAL E13-2A. Journalize, record, and post when appropnate the following transactions into the Journalizing, recording. and sales journal (same headings as excrcise E13-1 ) and general journal (page 1). posting that includos credit All ales carry terms of 2/10,n/30. momorandum (1)2(15min) 2022 May 17 Sold merchandise on akcount to Ronald Ca, invoice No. 147. $1,200, plus 5% GST. Cost of inventory, $900. 18 Sold merchandise on account to Bass Co, invoice No,148, $1,900, plus 5\% GST. Cost of inventory, \$1,425. 21 Issued credit memorandum Na. 12 to Bass Co. for defective merchandise, 5700 , plus 5% GST. Inventory was not returned. Use the following account numbers: Accounts Reccivable, 112; Inventory, 115; GST Payable, 225; Sales, 411: Sales Returns and Allowances, 412; Cost of Goods Sold, 502. SPECLAL JOURNALS WITH TAXES Journalizing transaction into E13-3A. From exercise E13-2A, journalize the receipt of a cheque from Ronald Co. for cash receipts journal payment of invoice No. 147 on May 25, 2022, in the ansh receipts journal. SALES JOURNAL GENERAL JOURNAL Sales Returns \& Allowances 41 c Eost of Goods Sold 502 Journalizing transaction into E13-3A. From exercise E13-2A, journalize the receipt of a cheque from Ronald Co. for cash recelpes journal payment of invoice No. 147 on May 25, 2022, in the cash receipts journal. CASH RECEIPTS JOURNAL

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts