Question: E13-31 & E13-32 E13-31. (Ioientifying the appropriate net asset classification) For each of the following transactions, identify the net asset classification (without donor restrictions, with

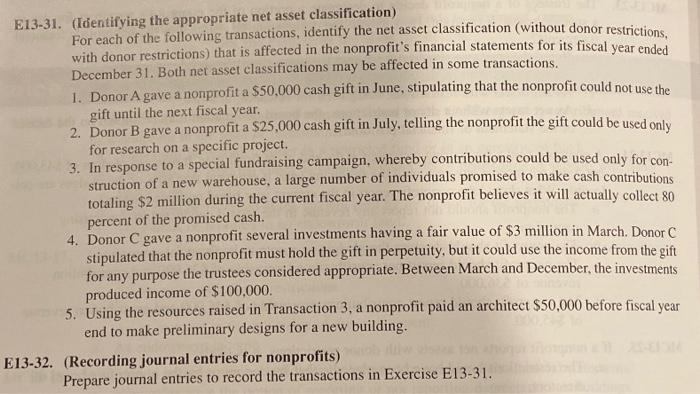

E13-31. (Ioientifying the appropriate net asset classification) For each of the following transactions, identify the net asset classification (without donor restrictions, with donor restrictions) that is affected in the nonprofit's financial statements for its fiscal year ended December 31. Both net asset classifications may be affected in some transactions. 1. Donor A gave a nomprofit a $50,000 cash gift in June, stipulating that the nonprofit could not use the gift until the next fiscal year. 2. Donor B gave a nonprofit a $25,000 cash gift in July, telling the nonprofit the gift could be used only for research on a specific project. 3. In response to a special fundraising campaign, whereby contributions could be used only for construction of a new warehouse, a large number of individuals promised to make cash contributions totaling $2 million during the current fiscal year. The nonprofit believes it will actually collect 80 percent of the promised cash. 4. Donor C gave a nonprofit several investments having a fair value of $3 million in March. Donor C stipulated that the nonprofit must hold the gift in perpetuity, but it could use the income from the gift for any purpose the trustees considered appropriate. Between March and December, the investments produced income of $100,000. 5. Using the resources raised in Transaction 3 , a nonprofit paid an architect $50,000 before fiscal year end to make preliminary designs for a new building. 13-32. (Recording journal entries for nonprofits) Prepare journal entries to record the transactions in Exercise E13-31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts