Question: E13-7 Computing and Interpreting Selected Liquidity Ratios [LO 13-4, LO 13-5] Double West Suppliers (DWS) reported sales for the year of $330,000, all on credit.

![E13-7 Computing and Interpreting Selected Liquidity Ratios [LO 13-4, LO 13-5]](https://s3.amazonaws.com/si.experts.images/answers/2024/09/66de680ca1fb9_66066de680c3c651.jpg)

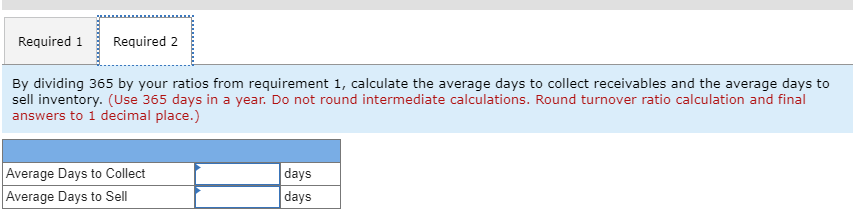

E13-7 Computing and Interpreting Selected Liquidity Ratios [LO 13-4, LO 13-5] Double West Suppliers (DWS) reported sales for the year of $330,000, all on credit. The average gross profit percentage was 40 percent on sales. Account balances follow: Accounts receivable (net) Inventory Beginning $ 48,000 63,000 Ending $58,000 43,000 Required: 1. Compute the following turnover ratios. 2. By dividing 365 by your ratios from requirement 1, calculate the average days to collect receivables and the average days to sell inventory. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the following turnover ratios. (Round your answers to 1 decimal place.) Receivables Turnover Ratio Inventory Turnover Ratio Required 1 Required 2 By dividing 365 by your ratios from requirement 1, calculate the average days to collect receivables and the average days to sell inventory. (Use 365 days in a year. Do not round intermediate calculations. Round turnover ratio calculation and final answers to 1 decimal place.) Average Days to Collect Average Days to Sell days days

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts