Question: E17.21 (LO 1, 2, 4) (Fair Value Option) Presented below is selected information related to the financial instruments of Dawson Company at December 31, 2020.

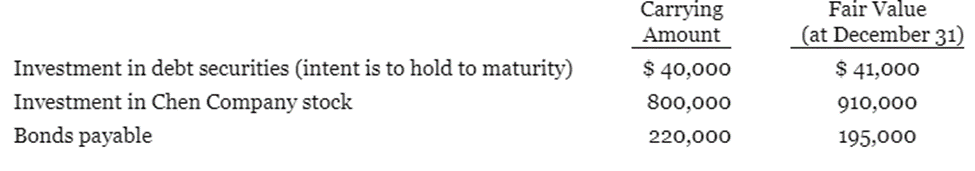

E17.21 (LO 1, 2, 4) (Fair Value Option) Presented below is selected information related to the financial instruments of Dawson Company at December 31, 2020. This is Dawson Company's first year of operations.

a. Dawson elects to use the fair value option for these investments. Assuming that Dawson's net income is $100,000 in 2020 before reporting any securities gains or losses, determine Dawson's net income for 2020. Assume that the difference between the carrying value and fair value is due to credit deterioration.

b. Record the journal entry, if any, necessary on December 31, 2020, to record the fair value option for the bonds payable.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts