Question: E19.16 (LO 1, 2) (Three Differences, Multiple Rates, Future Taxable Income) During 2022, Graham plc's first year of operations, the company reports pretax financial income

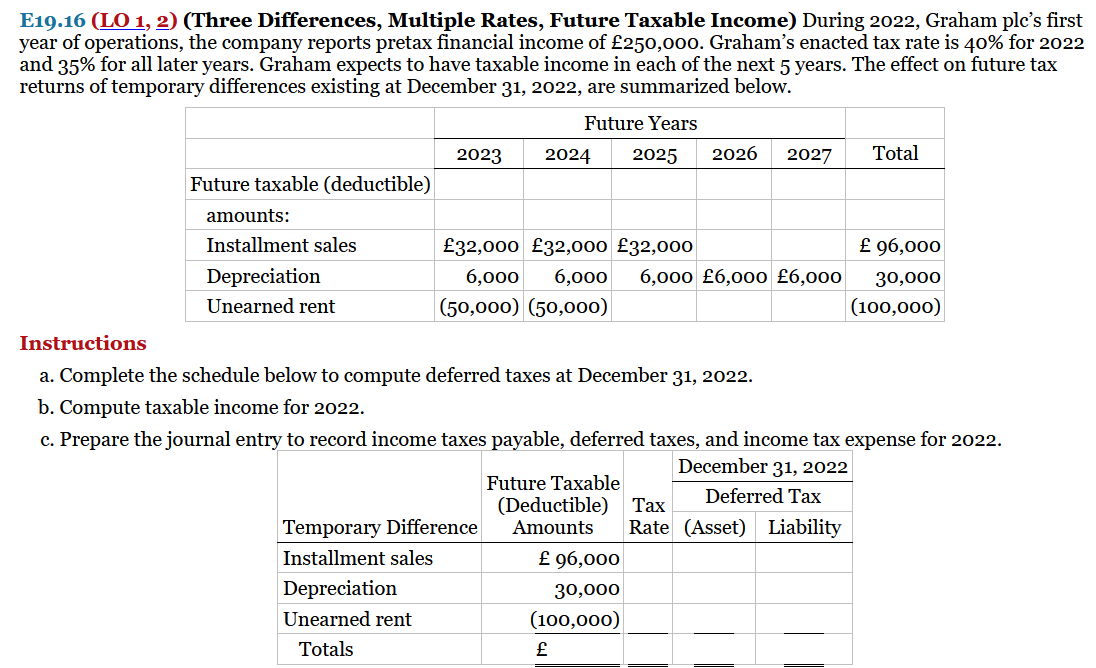

E19.16 (LO 1, 2) (Three Differences, Multiple Rates, Future Taxable Income) During 2022, Graham plc's first year of operations, the company reports pretax financial income of 250,000. Graham's enacted tax rate is 40% for 2022 and 35% for all later years. Graham expects to have taxable income in each of the next 5 years. The effect on future tax returns of temporary differences existing at December 31,2022 , are summarized below. Instructions a. Complete the schedule below to compute deferred taxes at December 31,2022. b. Compute taxable income for 2022. c. Prepare the journal entry to record income taxes payable, deferred taxes, and income tax expense for 2022

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts