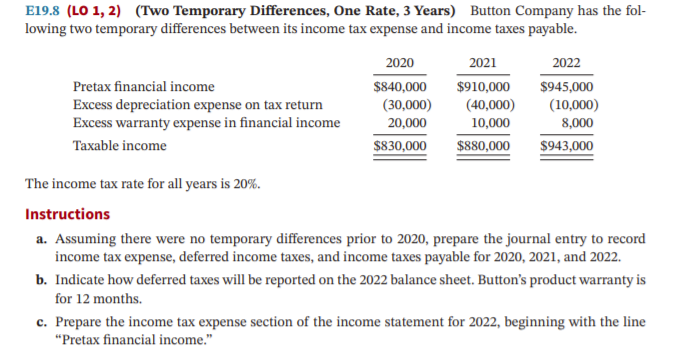

Question: E19.8 (LO 1, 2) (Two Temporary Differences, One Rate, 3 Years) Button Company has the fol- lowing two temporary differences between its income tax

E19.8 (LO 1, 2) (Two Temporary Differences, One Rate, 3 Years) Button Company has the fol- lowing two temporary differences between its income tax expense and income taxes payable. Pretax financial income Excess depreciation expense on tax return Excess warranty expense in financial income Taxable income The income tax rate for all years is 20%. Instructions 2020 2021 2022 $840,000 $910,000 $945,000 (30,000) (40,000) (10,000) 20,000 10,000 8,000 $830,000 $880,000 $943,000 a. Assuming there were no temporary differences prior to 2020, prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2020, 2021, and 2022. b. Indicate how deferred taxes will be reported on the 2022 balance sheet. Button's product warranty is for 12 months. c. Prepare the income tax expense section of the income statement for 2022, beginning with the line "Pretax financial income."

Step by Step Solution

There are 3 Steps involved in it

To solve this problem follow these steps for each year a Journal Entries for Income Tax Expense Deferred Tax and Income Taxes Payable 1 Calculate Defe... View full answer

Get step-by-step solutions from verified subject matter experts