Question: E20-6. Computing Basic and Diluted EPS, Convertible Bonds Issued during the Year, Preferred Stock Issued during the Year. [Learning Objective 1, 2] On January 1,

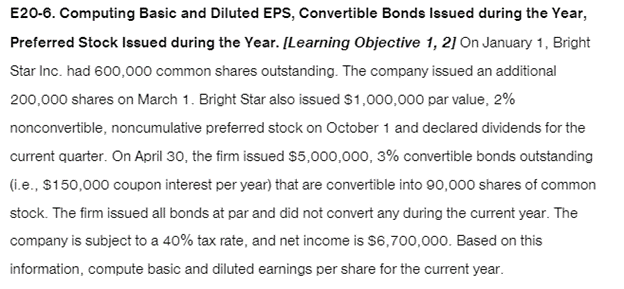

E20-6. Computing Basic and Diluted EPS, Convertible Bonds Issued during the Year, Preferred Stock Issued during the Year. [Learning Objective 1, 2] On January 1, Bright Star Inc. had 600,000 common shares outstanding. The company issued an additional 200,000 shares on March 1. Bright Star also issued $1,000,000 par value, 2% nonconvertible, noncumulative preferred stock on October 1 and declared dividends for the current quarter. On April 30 , the firm issued $5,000,000,3% convertible bonds outstanding (i.e., $150,000 coupon interest per year) that are convertible into 90,000 shares of common stock. The firm issued all bonds at par and did not convert any during the current year. The company is subject to a 40% tax rate, and net income is $6,700,000. Based on this information, compute basic and diluted earnings per share for the current year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts