Question: E23-20 Computing overhead variances Learning Objective 4 Mason Fender is a competitor of Matthews Fender from Exercise E23-19. Mason Fender also uses a standard cost

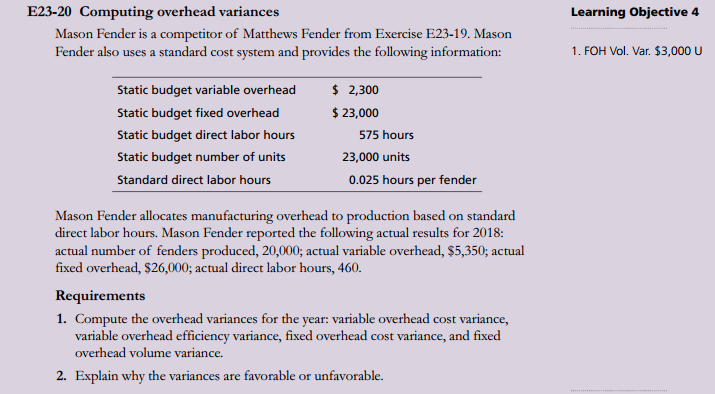

E23-20 Computing overhead variances Learning Objective 4 Mason Fender is a competitor of Matthews Fender from Exercise E23-19. Mason Fender also uses a standard cost system and provides the following information: 1. FOH Vol. Var. $3,000 U $ 2,300 23,000 Static budget variable overhead Static budget fixed overhead Static budget direct labor hours Static budget number of units Standard direct labor hours 575 hours 23,000 units 0.025 hours per fender Mason Fender allocates manufacturing overhead to production based on standard direct labor hours. Mason Fende actual number of fenders produced, 20,000, actual variable overhead, $5,350, actual fixed overhead, $26,000; actual direct labor hours, 460. Requirements r reported the following actual results for 2018 1. Compute the overhead variances for the year: variable overhead cost variance, variable overhead efficiency variance, fixed overhead cost variance, and fixed overhead volume variance. 2. Explain why the variances are favorable or unfavorable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts