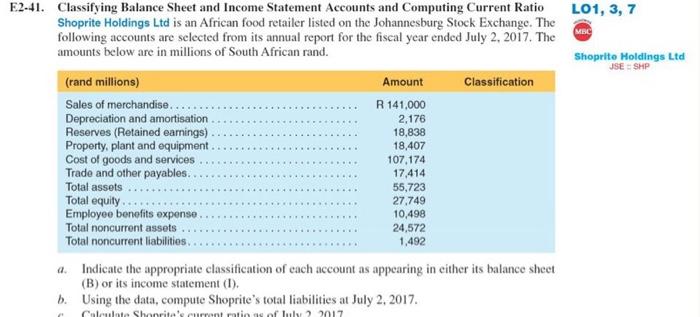

Question: E2-41. Classifying Balance Sheet and Income Statement Accounts and Computing Current Ratio Shoprite Holdings Ltd is an African food retailer listed on the Johannesburg

E2-41. Classifying Balance Sheet and Income Statement Accounts and Computing Current Ratio Shoprite Holdings Ltd is an African food retailer listed on the Johannesburg Stock Exchange. The following accounts are selected from its annual report for the fiscal year ended July 2, 2017. The amounts below are in millions of South African rand. (rand millions) Sales of merchandise... Depreciation and amortisation Reserves (Retained earnings) Property, plant and equipment. Cost of goods and services Trade and other payables.. Total assets Total equity... Employee benefits expense. Total noncurrent assets Total noncurrent liabilities.. Amount Classification R 141,000 2,176 18,838 18,407 107,174 17,414 55,723 27,749 10,498 24,572 1,492 a. Indicate the appropriate classification of each account as appearing in either its balance sheet (B) or its income statement (I). b. Using the data, compute Shoprite's total liabilities at July 2, 2017. Calculate Shoprite's current ratio as of July 2, 2017 LO1, 3, 7 MBC Shoprite Holdings Ltd JSE SHP

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts