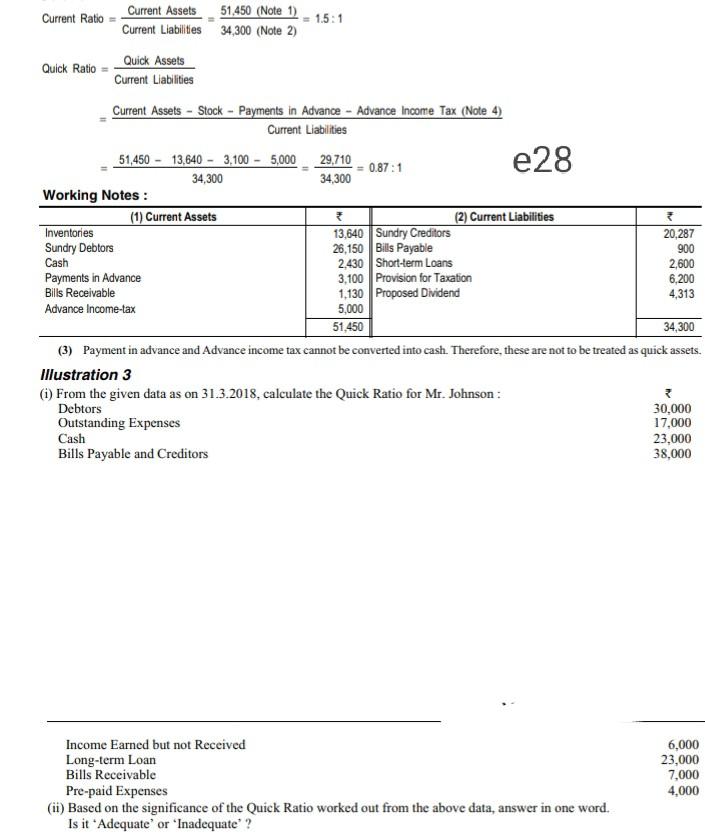

Question: e28 Current Ratio Current Assets 51,450 (Note 1) 1.5: 1 Current Liabilities 34,300 (Note 2) Quick Ratio Quick Assets Current Liabilities Current Assets - Stock

e28 Current Ratio Current Assets 51,450 (Note 1) 1.5: 1 Current Liabilities 34,300 (Note 2) Quick Ratio Quick Assets Current Liabilities Current Assets - Stock - Payments in Advance - Advance Income Tax (Note 4) Current Liabilities 51,450 - 13,640 - 3,100 - 5,000 29,710 0.87:1 34,300 34,300 Working Notes: (1) Current Assets (2) Current Liabilities Inventories 13,640 Sundry Creditors 20,287 Sundry Debtors 26,150 Bills Payable 900 Cash 2,430 Short-term Loans 2,600 Payments in Advance 3,100 Provision for Taxation 6,200 Bills Receivable 1,130 Proposed Dividend 4,313 Advance Income tax 5,000 51,450 34,300 (3) Payment in advance and Advance income tax cannot be converted into cash. Therefore, these are not to be treated as quick assets. Illustration 3 (i) From the given data as on 31.3.2018, calculate the Quick Ratio for Mr. Johnson: Debtors 30,000 Outstanding Expenses 17,000 Cash 23,000 Bills Payable and Creditors 38,000 Income Earned but not Received Long-term Loan Bills Receivable Pre-paid Expenses (ii) Based on the significance of the Quick Ratio worked out from the above data, answer in one word. Is it Adequate' or 'Inadequate"? 6,000 23,000 7,000 4,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts