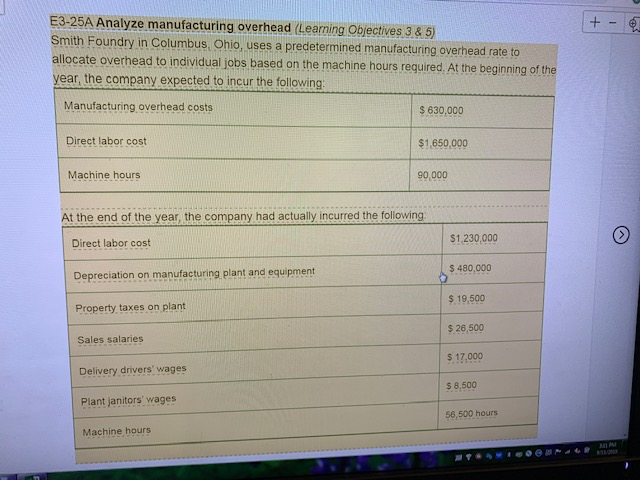

Question: + - E3-25A Analyze manufacturing overhead (Learning Objectives 3 & 5) Smith Foundry in Columbus, Ohio, uses a predetermined manufacturing overhead rate to allocate overhead

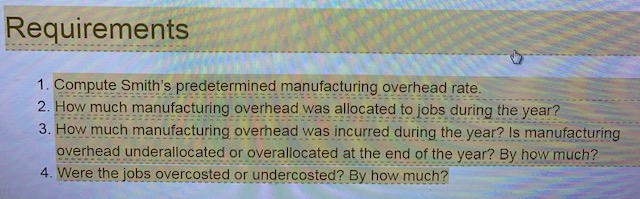

+ - E3-25A Analyze manufacturing overhead (Learning Objectives 3 & 5) Smith Foundry in Columbus, Ohio, uses a predetermined manufacturing overhead rate to allocate overhead to individual jobs based on the machine hours required. At the beginning of the year, the company expected to incur the following: Manufacturing overhead costs $ 630,000 Direct labor cost $1,650,000 Machine hours 90,000 At the end of the year, the company had actually incurred the following Direct labor cost $1.230,000 $ 480,000 Depreciation on manufacturing plant and equipment $ 19,500 Property taxes on plant $ 26,500 Sales salaries $ 17.000 Delivery drivers' wages $ 8,500 Plant janitors' wages 56,500 hours Machine hours Wide Requirements 1. Compute Smith's predetermined manufacturing overhead rate. 2. How much manufacturing overhead was allocated to jobs during the year? 3. How much manufacturing overhead was incurred during the year? Is manufacturing overhead underallocated or overallocated at the end of the year? By how much? 4. Were the jobs overcosted or undercosted? By how much

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts