Question: E4-16 Recording Four Adjusting Entries, Completing a Trial Balance, Preparing Financial Statements, and Recording Closing Entries LO4-1, 4-2, 4-4 Cayuga Ltd. prepared the following trial

E4-16 Recording Four Adjusting Entries, Completing a Trial Balance, Preparing Financial Statements, and Recording Closing Entries LO4-1, 4-2, 4-4

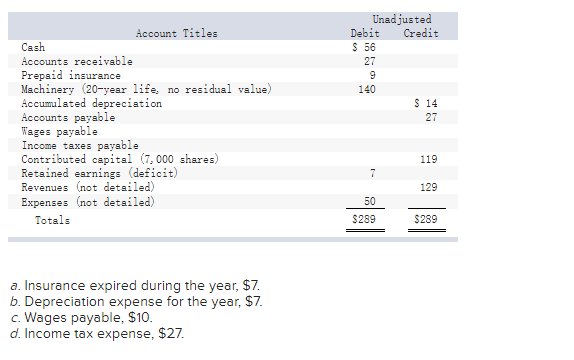

Cayuga Ltd. prepared the following trial balance at the end of its first year of operations ended December 31. To simplify the case, the amounts given are in thousands of dollars. Other data not yet recorded at December 31 are as follows:

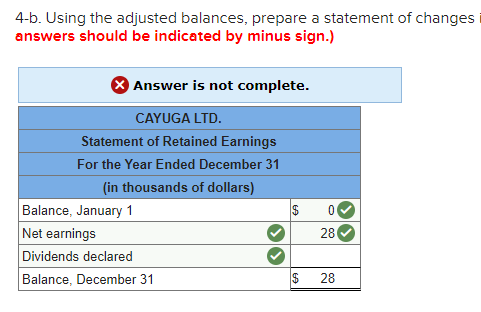

Please help me complete questions 4-b, and 6. Thanks!

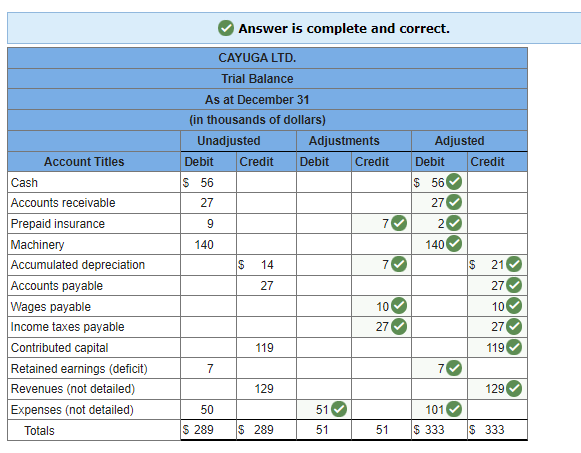

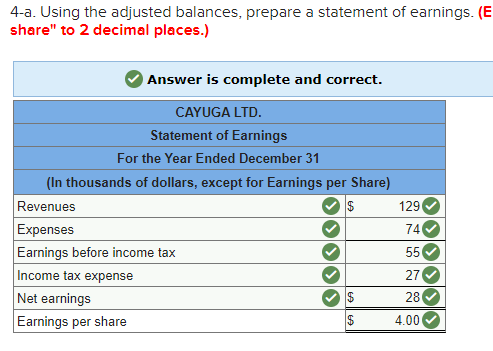

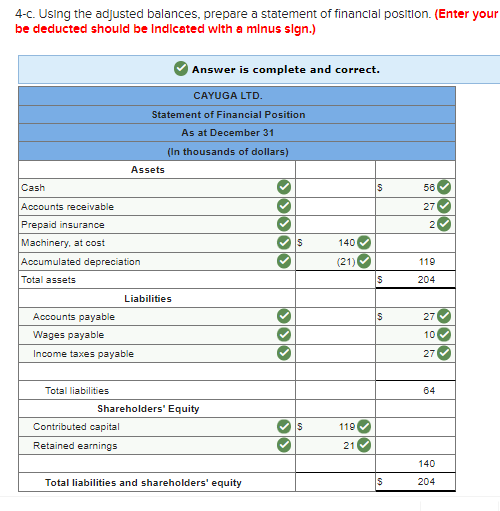

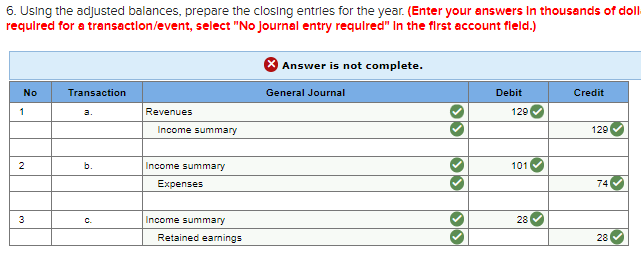

Unadjusted Debit Credit S 56 27 9 140 S 14 27 Account Titles Cash Accounts receivable Prepaid insurance Machinery (20-year life, no residual value) Accumulated depreciation Accounts payable Wages payable Income taxes payable Contributed capital (7.000 shares) Retained earnings (deficit) Revenues not detailed) Expenses (not detailed) Totals 119 7 129 ||| 50 $289 $289 a. Insurance expired during the year, $7. b. Depreciation expense for the year, $7. c. Wages payable, $10. d. Income tax expense, $27. Answer is complete and correct. CAYUGA LTD. Trial Balance As at December 31 (in thousands of dollars) Unadjusted Adjustments Debit Credit Debit Credit Adjusted Debit Credit Account Titles $ 56 $ 56 27 27 9 7 2 140 140 S 14 7 S 21 27 27 Cash Accounts receivable Prepaid insurance Machinery Accumulated depreciation Accounts payable Wages payable Income taxes payable Contributed capital Retained earnings (deficit) Revenues not detailed) Expenses (not detailed) Totals 10 10 27 27 119 119 7 7 129 129 50 51 101 $ 289 $ 289 51 51 $ 333 $ 333 4-a. Using the adjusted balances, prepare a statement of earnings. (E share" to 2 decimal places.) Answer is complete and correct. CAYUGA LTD. Statement of Earnings For the Year Ended December 31 (In thousands of dollars, except for Earnings per Share) Revenues $ Expenses 74 Earnings before income tax 55 Income tax expense 27 Net earnings Earnings per share 4.00 129 $ 28 $ 4-b. Using the adjusted balances, prepare a statement of changes answers should be indicated by minus sign.) Answer is not complete. CAYUGA LTD. Statement of Retained Earnings For the Year Ended December 31 (in thousands of dollars) Balance, January 1 Net earnings Dividends declared Balance, December 31 $ 0 28 $ 28 4-c. Using the adjusted balances, prepare a statement of financial position. (Enter your be deducted should be Indicated with a minus sign.) Answer is complete and correct. CAYUGA LTD. Statement of Financial Position As at December 31 (In thousands of dollars) Assets Cash IS 56 27 Accounts receivable Prepaid insurance Machinery, at cost 2 S 140 OO (21) 119 Accumulated depreciation Total assets S 204 IS 27 Liabilities Accounts payable Wages payable Income taxes payable OOO 10 27 64 Total liabilities Shareholders' Equity Contributed capital Retained earnings S 119 21 140 Total liabilities and shareholders' equity S 204 6. Using the adjusted balances, prepare the closing entries for the year. (Enter your answers in thousands of doll required for a transaction/event, select "No Journal entry required" In the first account field.) Answer is not complete. No Transaction General Journal Debit Credit 1 a. Revenues 129 Income summary 129 N 2 b. 101 Income summary Expenses 74 3 28 Income summary Retained earnings 28

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts