Question: E4-25B. (Learning Objective 3: Classifying assets based on liquidity) A thorough review of PG Broadcasting assets at the end of December 31, 20X5, resulted in

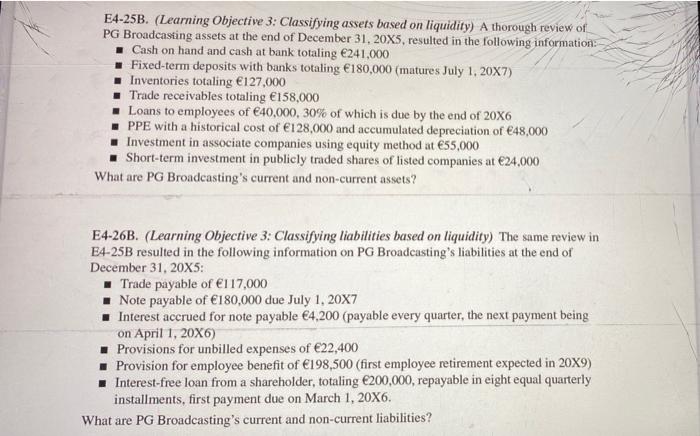

E4-25B. (Learning Objective 3: Classifying assets based on liquidity) A thorough review of PG Broadcasting assets at the end of December 31, 20X5, resulted in the following information: Cash on hand and cash at bank totaling 241,000 Fixed-term deposits with banks totaling 180,000 (matures July 1, 2007) Inventories totaling 127.000 Trade receivables totaling 158,000 Loans to employees of $40,000, 30% of which is due by the end of 20X6 PPE with a historical cost of 128,000 and accumulated depreciation of 48,000 Investment in associate companies using equity method at 55,000 Short-term investment in publicly traded shares of listed companies at 24,000 What are PG Broadcasting's current and non-current assets? E4-26B. (Learning Objective 3: Classifying liabilities based on liquidity) The same review in E4-25B resulted in the following information on PG Broadcasting's liabilities at the end of December 31, 20X5: Trade payable of 117.000 Note payable of 180,000 due July 1, 20x7 Interest accrued for note payable 4,200 (payable every quarter, the next payment being on April 1, 20X6) Provisions for unbilled expenses of 22,400 Provision for employee benefit of 198,500 (first employee retirement expected in 20X9) Interest-free loan from a shareholder, totaling 200,000, repayable in eight equal quarterly installments, first payment due on March 1, 20X6. What are PG Broadcasting's current and non-current liabilities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts