Question: E4-4 Classifications on Balance Sheet A balance sheet may contain the following major sections: LO 4.3 A. Current assets F. Current liabilities B. Long-term investments

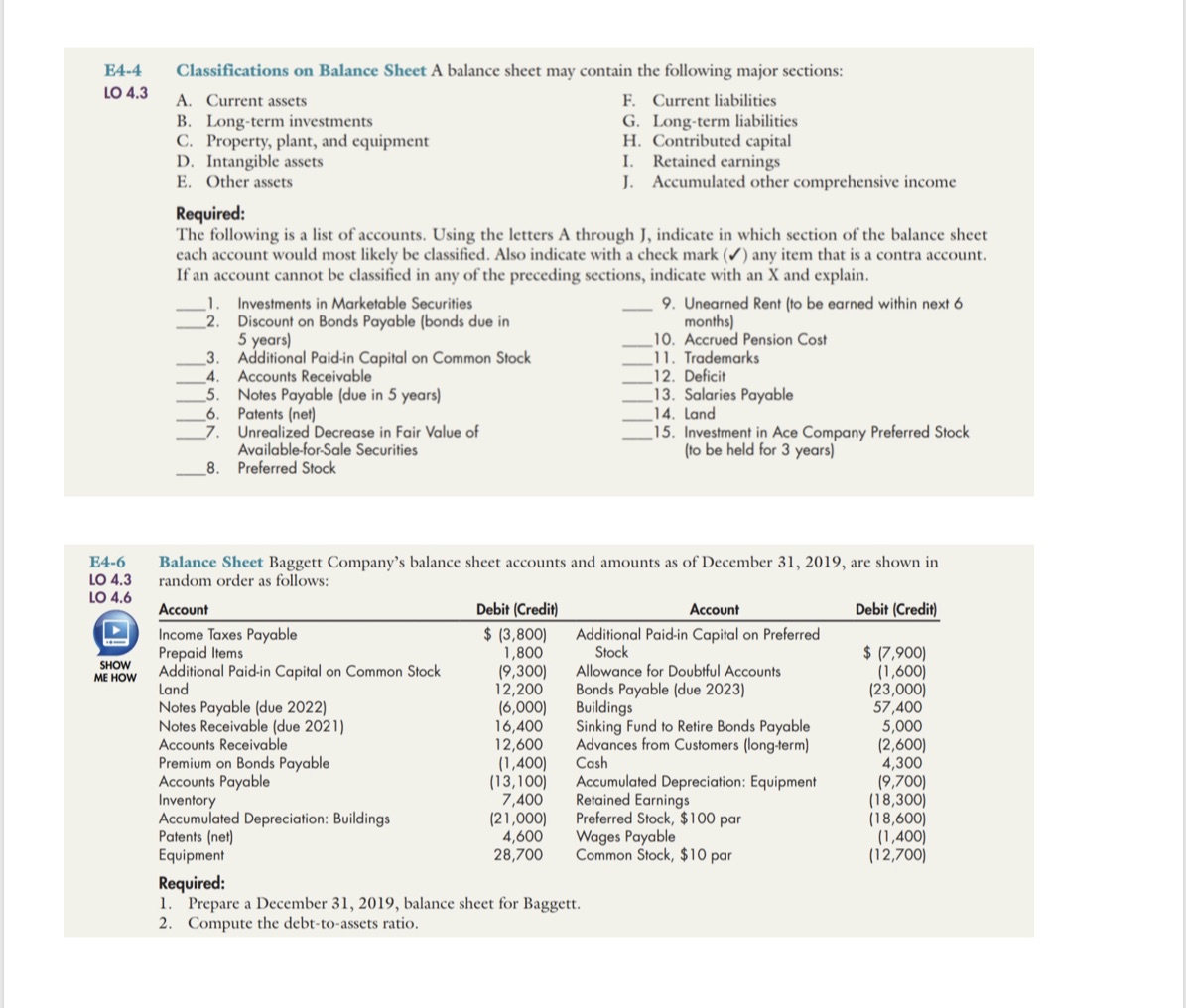

E4-4 Classifications on Balance Sheet A balance sheet may contain the following major sections: LO 4.3 A. Current assets F. Current liabilities B. Long-term investments G. Long-term liabilities C. Property, plant, and equipment H. Contributed capital D. Intangible assets I. Retained earnings E. Other assets J. Accumulated other comprehensive income Required: The following is a list of accounts. Using the letters A through J, indicate in which section of the balance sheet each account would most likely be classified. Also indicate with a check mark ( ) any item that is a contra account. If an account cannot be classified in any of the preceding sections, indicate with an X and explain. 1. Investments in Marketable Securities 9. Unearned Rent (to be earned within next 6 _2. Discount on Bonds Payable (bonds due in months) 5 years) 10. Accrued Pension Cost 3. Additional Paid-in Capital on Common Stock 11. Trademarks 4. Accounts Receivable 12. Deficit _5. Notes Payable (due in 5 years) 13. Salaries Payable Patents (net) 14. Land Unrealized Decrease in Fair Value of 15. Investment in Ace Company Preferred Stock Available-for-Sale Securities (to be held for 3 years) 8. Preferred Stock E4-6 Balance Sheet Baggett Company's balance sheet accounts and amounts as of December 31, 2019, are shown in LO 4.3 random order as follows: LO 4.6 Account Debit (Credit) Account Debit (Credit) Income Taxes Payable $ (3,800) Additional Paid-in Capital on Preferred Prepaid Items 1,800 Stock $ (7,900) SHOW Additional Paid-in Capital on Common Stock (1,600) ME HOW (9,300) Allowance for Doubtful Accounts Land 12,200 Bonds Payable (due 2023) (23,000) Notes Payable (due 2022) (6,000) Buildings 57,400 Notes Receivable (due 2021) 16,400 Sinking Fund to Retire Bonds Payable 5,000 Accounts Receivable 12,600 Advances from Customers (long-term) (2,600) Premium on Bonds Payable (1,400) Cash 4,300 Accounts Payable (13, 100) Accumulated Depreciation: Equipment (9,700) Inventory 7,400 Retained Earnings (18,300) Accumulated Depreciation: Buildings (21,000) Preferred Stock, $100 par (18,600 Patents (net) 4,600 Wages Payable (1,400) Equipment 28,700 Common Stock, $10 par (12,700) Required: 1. Prepare a December 31, 2019, balance sheet for Baggett. 2. Compute the debt-to-assets ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts