Question: E4-9 Instructions (a) Prepare closing entries at June 30, 2017. (b) Prepare a post-closing trial balance. Journalize and potlosing E4-8 Windsor Company, Ltd. ended its

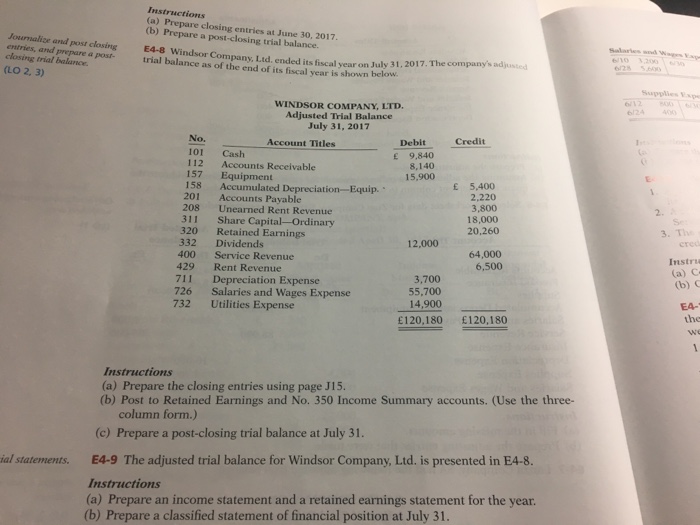

Instructions (a) Prepare closing entries at June 30, 2017. (b) Prepare a post-closing trial balance. Journalize and potlosing E4-8 Windsor Company, Ltd. ended its fiscal year on July >l entries, and prepare a post- closing trial balance Salaries sd We Vap trial balance as of the end of its fiscal year is shown (LO 2, 3) WINDSOR COMPANY, LTD. Adjusted Trial Balance July 31, 2017 6/24 No. Account Titles Debit Credit 101 Cash E 9,840 8,140 15,900 112 Accounts Receivable 157 Equipment 158 Accumulated Depreciation-Equip. 201 Accounts Payable 208 Unearned Rent Revenue 311 Share Capital-Ordinary 320 Retained Earnings 332 Dividends E 5,400 2,220 3,800 18,000 20,260 S- 3. Th 12,000 cred Instra (b) C 400 Service Revenue 64,000 429 Rent Revenue 711 Depreciation Expense 726 732 (a) C 3,700 6,500 Salaries and Wages Expense Utilities Expense 55,700 14,900 EA- the we 120,180 120,180 Instructions (a) Prepare the closing entries using page J15. (b) Post to Retained Earnings and No. 350 Income Summary accounts. (Use the three- column form.) (c) Prepare a post-closing trial balance at July 31. al statements. E4-9 The adjusted trial balance for Windsor Company, Ltd. is presented in E4-8. Instructions (a) Prepare an income statement and a retained earnings statement for the year. (b) Prepare a classified statement of financial position at July 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts