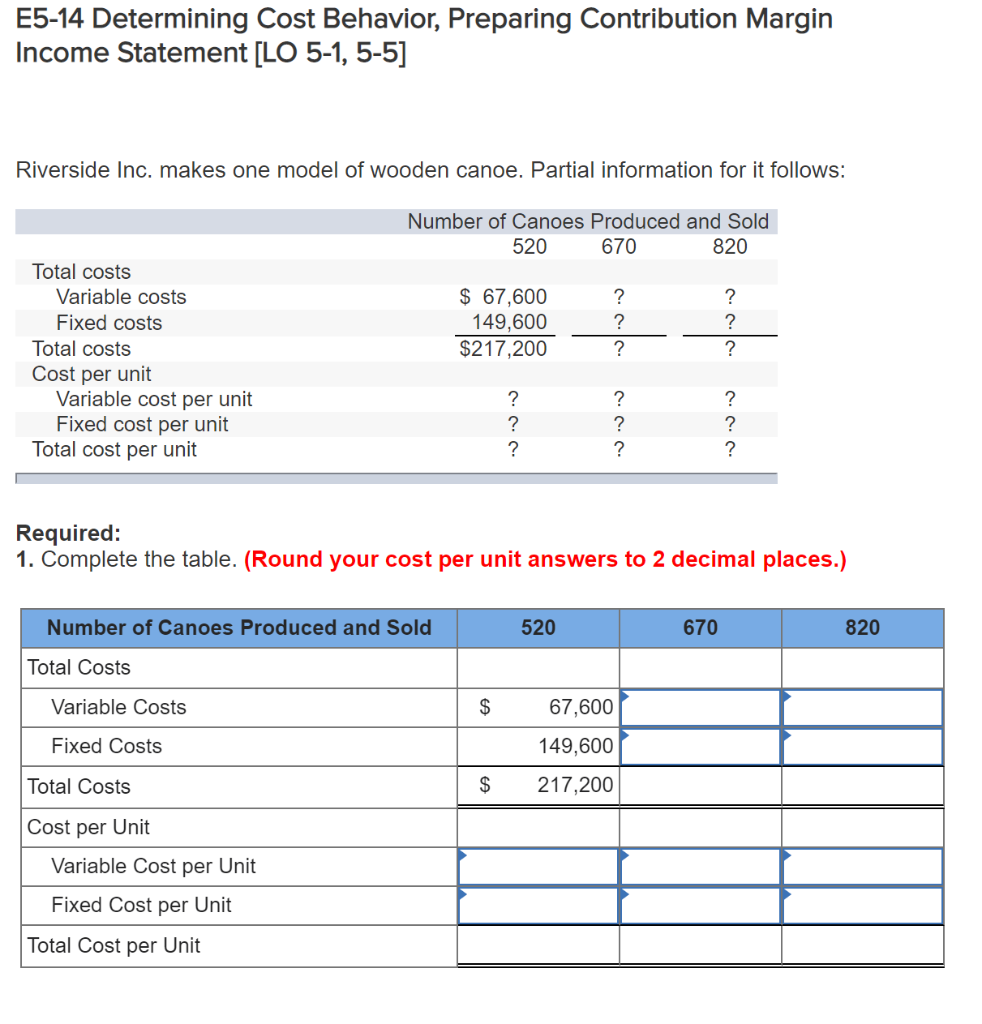

Question: E5-14 Determining Cost Behavior, Preparing Contribution Margin Income Statement [LO 5-1, 5-5] Riverside Inc. makes one model of wooden canoe. Partial information for it follows:

![5-5] Riverside Inc. makes one model of wooden canoe. Partial information for](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e714aead8f9_14266e714ae285fb.jpg)

E5-14 Determining Cost Behavior, Preparing Contribution Margin Income Statement [LO 5-1, 5-5] Riverside Inc. makes one model of wooden canoe. Partial information for it follows: Number of Canoes Produced and Sold 520 670 820 Total costs Variable costs Fixed costs $ 67,600 149,600 $217,200 Total costs Cost per unit Variable cost per unit Fixed cost per unit Total cost per unit Required: 1. Complete the table. (Round your cost per unit answers to 2 decimal places.) Number of Canoes Produced and Sold 520 670 820 Total Costs 67,600 149,600 $217,200 Variable Costs Fixed Costs Total Costs Cost per Unit Variable Cost per Unit Fixed Cost per Unit Total Cost per Unit 3. Suppose Riverside sells its canoes for $502 each. Calculate the contribution margin per canoe and the contribution margin ratio. (Round your contribution margin to the nearest whole dollar and your contribution margin ratio to the nearest whole percent.) Unit Contribution Margin Contribution Margin Ratio 4. Next year Riverside expects to sell 870 canoes. Complete the contribution margin income statement for the company. RIVERSIDE INC Contribution Margin Income Statement For the Next Year Contribution Margin Net Operating Income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts