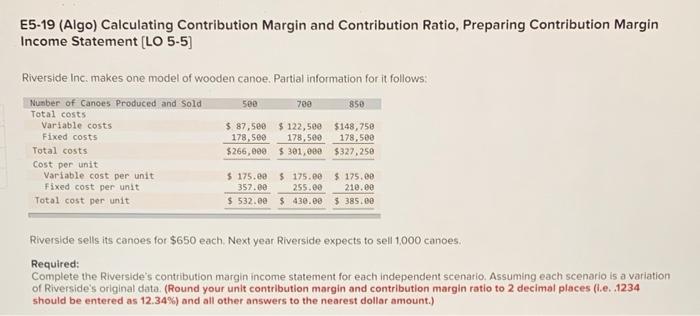

Question: E5-19 (Algo) Calculating Contribution Margin and Contribution Ratio, Preparing Contribution Margin Income Statement (LO 5-5) Riverside Inc. makes one model of wooden canoe. Partial information

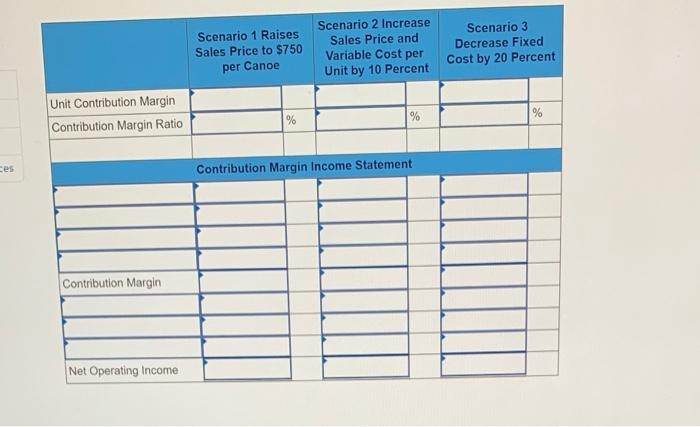

E5-19 (Algo) Calculating Contribution Margin and Contribution Ratio, Preparing Contribution Margin Income Statement (LO 5-5) Riverside Inc. makes one model of wooden canoe. Partial information for it follows: Number of Canoes Produced and sold 500 700 850 Total costs Variable costs Fixed costs Total costs $ 87,5ee $ 122,500 $148,750 178, see 178,500 178,588 $266,000 $301,000 $327,250 Cost per unit Variable cost per unit Fixed cost per unit Total cost per unit $ 175.ee $175.00 $175.00 357.be 255.ee 210.00 $ 532.60 $ 430.ee $385.00 Riverside sells its canoes for $650 each. Next year Riverside expects to sell 1000 cances, Required: Complete the Riverside's contribution margin income statement for each independent scenario. Assuming each scenario is a variation of Riverside's original data (Round your unit contribution margin and contribution margin ratio to 2 decimal places (.e. 1234 should be entered as 12.34%) and all other answers to the nearest collar amount.) Scenario 1 Raises Sales Price to $750 per Canoe Scenario 2 Increase Sales Price and Variable Cost per Unit by 10 Percent Scenario 3 Decrease Fixed Cost by 20 Percent Unit Contribution Margin Contribution Margin Ratio % % ces Contribution Margin Income Statement Contribution Margin Net Operating Income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts