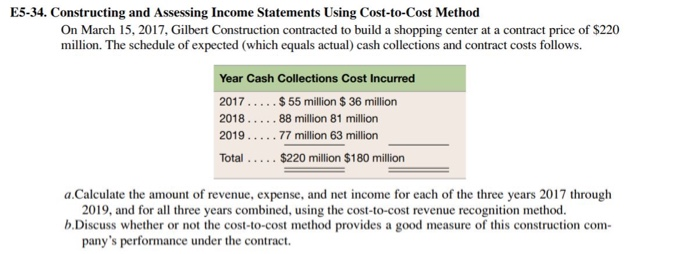

Question: E5-34. Constructing and Assessing Income Statements Using Cost-to-Cost Method On March 15, 2017, Gilbert Construction contracted to build a shopping center at a contract price

E5-34. Constructing and Assessing Income Statements Using Cost-to-Cost Method On March 15, 2017, Gilbert Construction contracted to build a shopping center at a contract price of $220 million. The schedule of expected (which equals actual) cash collections and contract costs follows. Year Cash Collections Cost Incurred 2017... . . $ 55 million $ 36 million 2018..... 88 million 81 million 2019. ... .77 million 63 million Total ..... $220 million $180 million a.Calculate the amount of revenue, expense, and net income for each of the three years 2017 through 2019, and for all three years combined, using the cost-to-cost revenue recognition method. b.Discuss whether or not the cost-to-cost method provides a good measure of this construction com- pany's performance under the contract

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts