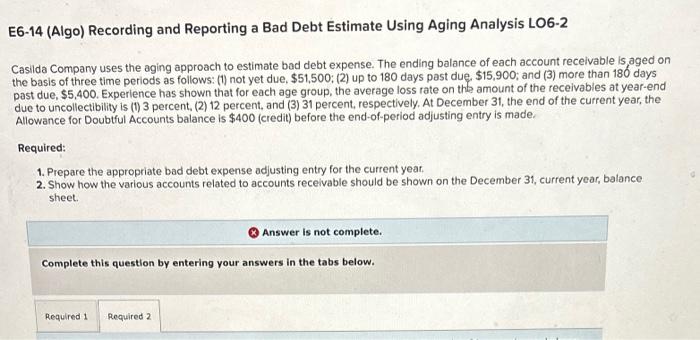

Question: E6-14 (Algo) Recording and Reporting a Bad Debt Estimate Using Aging Analysis LO6-2 Casilda Company uses the aging approach to estimate bad debt expense. The

E6-14 (Algo) Recording and Reporting a Bad Debt Estimate Using Aging Analysis LO6-2 Casilda Company uses the aging approach to estimate bad debt expense. The ending balance of each account receivable is, aged on the basis of three time periods as follows: (1) not yet due, $51,500:(2) up to 180 days past due, $15,900; and (3) more than 180 days past due, $5,400. Experience has shown that for each age group, the average loss rate on the amount of the receivabies at year-end due to uncollectibility is (1) 3 percent, (2) 12 percent, and (3) 31 percent, respectively. At December 31 , the end of the current year, the Allowance for Doubtful Accounts balance is $400 (credit) before the end-of-period adjusting entry is made. Required: 1. Prepare the appropriate bad debt expense adjusting entry for the current yeat. 2. Show how the various accounts related to accounts receivable should be shown on the December 31 , current year, balance sheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts