Question: E6-24 (Algo) Computing Target Profit, Preparing Contribution Margin Income Statement, Computing Margin of Safety [LO 6-2, 6-3] Erin Shelton, Inc., wants to earn a target

![Margin of Safety [LO 6-2, 6-3] Erin Shelton, Inc., wants to earn](https://s3.amazonaws.com/si.experts.images/answers/2024/08/66d2e11fd381a_22366d2e11f66530.jpg)

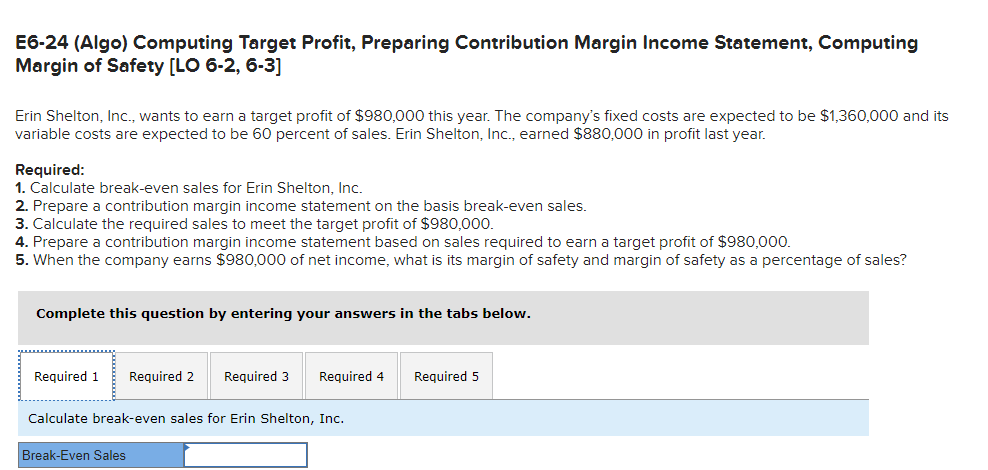

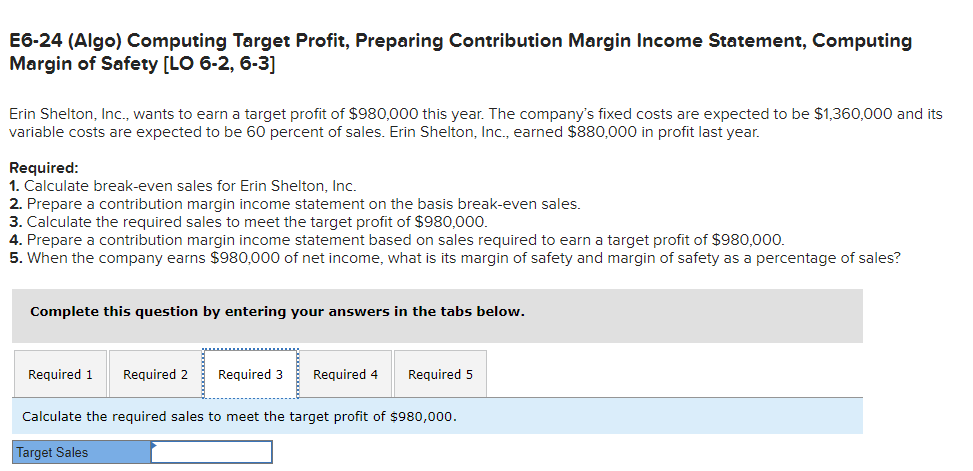

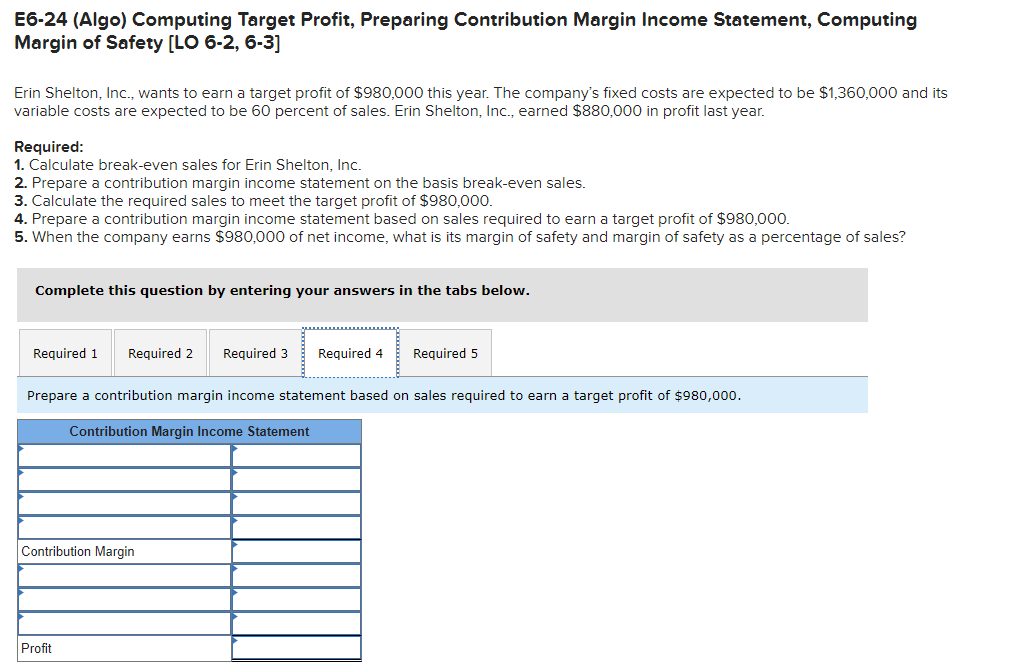

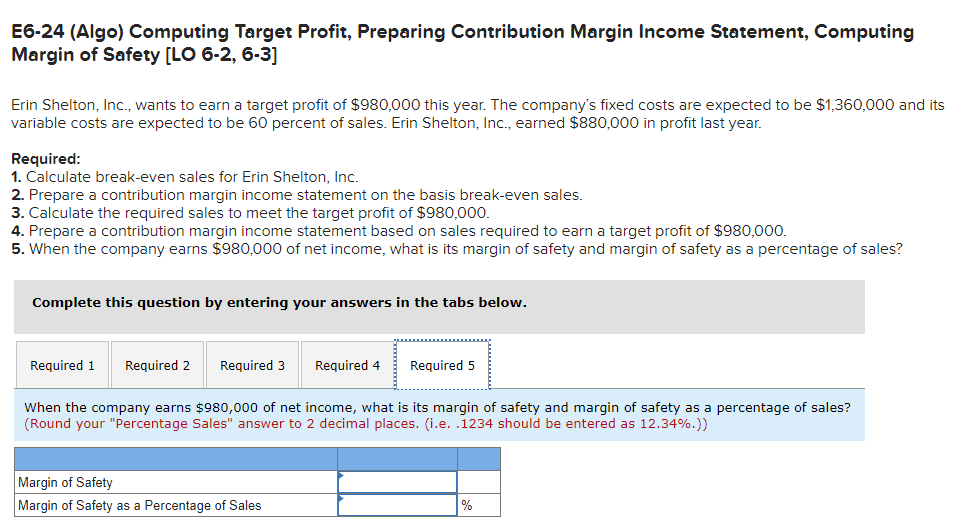

E6-24 (Algo) Computing Target Profit, Preparing Contribution Margin Income Statement, Computing Margin of Safety [LO 6-2, 6-3] Erin Shelton, Inc., wants to earn a target profit of $980,000 this year. The company's fixed costs are expected to be $1,360,000 and its variable costs are expected to be 60 percent of sales. Erin Shelton, Inc., earned $880,000 in profit last year. Required: 1. Calculate break-even sales for Erin Shelton, Inc. 2. Prepare a contribution margin income statement on the basis break-even sales. 3. Calculate the required sales to meet the target profit of $980,000. 4. Prepare a contribution margin income statement based on sales required to earn a target profit of $980,000. 5. When the company earns $980,000 of net income, what is its margin of safety and margin of safety as a percentage of sales? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Calculate break-even sales for Erin Shelton, Inc. Break-Even Sales E6-24 (Algo) Computing Target Profit, Preparing Contribution Margin Income Statement, Computing Margin of Safety [LO 6-2, 6-3] Erin Shelton, Inc., wants to earn a target profit of $980,000 this year. The company's fixed costs are expected to be $1,360,000 and its variable costs are expected to be 60 percent of sales. Erin Shelton, Inc., earned $880,000 in profit last year. Required: 1. Calculate break-even sales for Erin Shelton, Inc. 2. Prepare a contribution margin income statement on the basis break-even sales. 3. Calculate the required sales to meet the target profit of $980,000. 4. Prepare a contribution margin income statement based on sales required to earn a target profit of $980,000. 5. When the company earns $980,000 of net income, what is its margin of safety and margin of safety as a percentage of sales? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Prepare a contribution margin income statement on the basis of break-even sales. Contribution Margin Income Statement Contribution Margin Profit E6-24 (Algo) Computing Target Profit, Preparing Contribution Margin Income Statement, Computing Margin of Safety [LO 6-2, 6-3] Erin Shelton, Inc., wants to earn a target profit of $980,000 this year. The company's fixed costs are expected to be $1,360,000 and its variable costs are expected to be 60 percent of sales. Erin Shelton, Inc., earned $880,000 in profit last year. Required: 1. Calculate break-even sales for Erin Shelton, Inc. 2. Prepare a contribution margin income statement on the basis break-even sales. 3. Calculate the required sales to meet the target profit of $980,000. 4. Prepare a contribution margin income statement based on sales required to earn a target profit of $980,000. 5. When the company earns $980,000 of net income, what is its margin of safety and margin of safety as a percentage of sales? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Calculate the required sales to meet the target profit of $980,000. Target Sales E6-24 (Algo) Computing Target Profit, Preparing Contribution Margin Income Statement, Computing Margin of Safety [LO 6-2, 6-3] Erin Shelton, Inc., wants to earn a target profit of $980,000 this year. The company's fixed costs are expected to be $1,360,000 and its variable costs are expected to be 60 percent of sales. Erin Shelton, Inc., earned $880,000 in profit last year. Required: 1. Calculate break-even sales for Erin Shelton, Inc. 2. Prepare a contribution margin income statement on the basis break-even sales. 3. Calculate the required sales to meet the target profit of $980,000. 4. Prepare a contribution margin income statement based on sales required to earn a target profit of $980,000. 5. When the company earns $980,000 of net income, what is its margin of safety and margin of safety as a percentage of sales? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Prepare a contribution margin income statement based on sales required to earn a target profit of $980,000. Contribution Margin Income Statement Contribution Margin Profit E6-24 (Algo) Computing Target Profit, Preparing Contribution Margin Income Statement, Computing Margin of Safety [LO 6-2, 6-3] Erin Shelton, Inc., wants to earn a target profit of $980,000 this year. The company's fixed costs are expected to be $1,360,000 and its variable costs are expected to be 60 percent of sales. Erin Shelton, Inc., earned $880,000 in profit last year. Required: 1. Calculate break-even sales for Erin Shelton, Inc. 2. Prepare a contribution margin income statement on the basis break-even sales. 3. Calculate the required sales to meet the target profit of $980,000. 4. Prepare a contribution margin income statement based on sales required to earn a target profit of $980,000. 5. When the company earns $980,000 of net income, what is its margin of safety and margin of safety as a percentage of sales? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 When the company earns $980,000 of net income, what is its margin of safety and margin of safety as a percentage of sales? (Round your "Percentage Sales" answer to 2 decimal places. i.e. .1234 should be entered as 12.34%.)) Margin of Safety Margin of Safety as a Percentage of Sales %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts