Question: E6-33B. (Learning Objective 3: Measuring gross profitFIFO vs. LIFO; Falling prices) Suppose a store in Milan ended September with 1,500,000 units of merchandise that cost

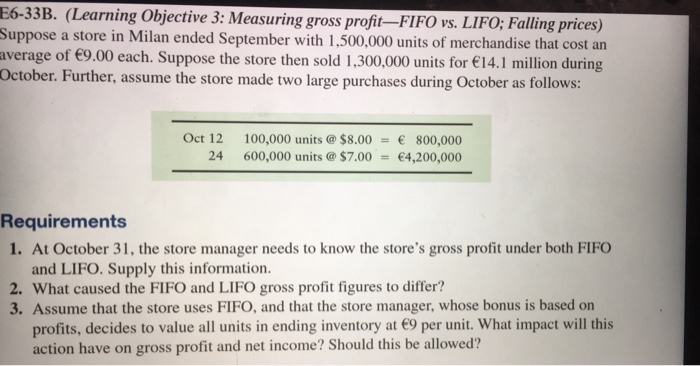

E6-33B. (Learning Objective 3: Measuring gross profitFIFO vs. LIFO; Falling prices) Suppose a store in Milan ended September with 1,500,000 units of merchandise that cost an average of 9.00 each. Suppose the store then sold 1,300,000 units for 14.1 million during October. Further, assume the store made two large purchases during October as follows: Oct 12 24 100,000 units @ $8.00 = 800,000 600,000 units @ $7.00 = 4,200,000 Requirements 1. At October 31, the store manager needs to know the store's gross profit under both FIFO and LIFO. Supply this information. 2. What caused the FIFO and LIFO gross profit figures to differ? 3. Assume that the store uses FIFO, and that the store manager, whose bonus is based on profits, decides to value all units in ending inventory at 9 per unit. What impact will this action have on gross profit and net income? Should this be allowed

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts