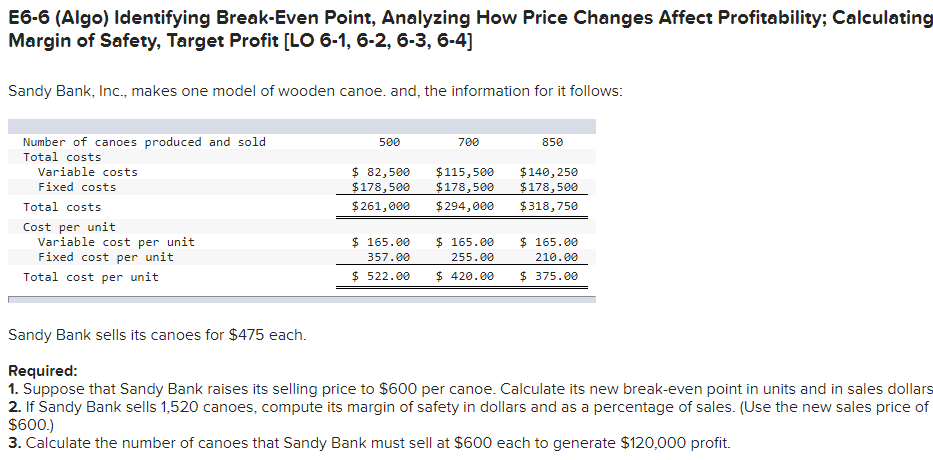

Question: E6-6 (Algo) Identifying Break-Even Point, Analyzing How Price Changes Affect Profitability; Calculating Margin of Safety, Target Profit [LO 6-1, 6-2, 6-3, 6-4) Sandy Bank, Inc.,

E6-6 (Algo) Identifying Break-Even Point, Analyzing How Price Changes Affect Profitability; Calculating Margin of Safety, Target Profit [LO 6-1, 6-2, 6-3, 6-4) Sandy Bank, Inc., makes one model of wooden canoe. and, the information for it follows: 500 700 850 Number of canoes produced and sold Total costs Variable costs Fixed costs Total costs Cost per unit Variable cost per unit Fixed cost per unit Total cost per unit $ 82,500 $ 178,500 $261,000 $115,500 $ 178,500 $ 294,000 $140, 250 $ 178,500 $318,750 $ 165.00 357.00 $ 165.00 255.00 $ 420.00 $ 165.00 210.00 $ 375.00 $ 522.00 Sandy Bank sells its canoes for $475 each. Required: 1. Suppose that Sandy Bank raises its selling price to $600 per canoe. Calculate its new break-even point in units and in sales dollars 2. If Sandy Bank sells 1,520 canoes, compute its margin of safety in dollars and as a percentage of sales. (Use the new sales price of $600.) 3. Calculate the number of canoes that Sandy Bank must sell at $600 each to generate $120,000 profit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts