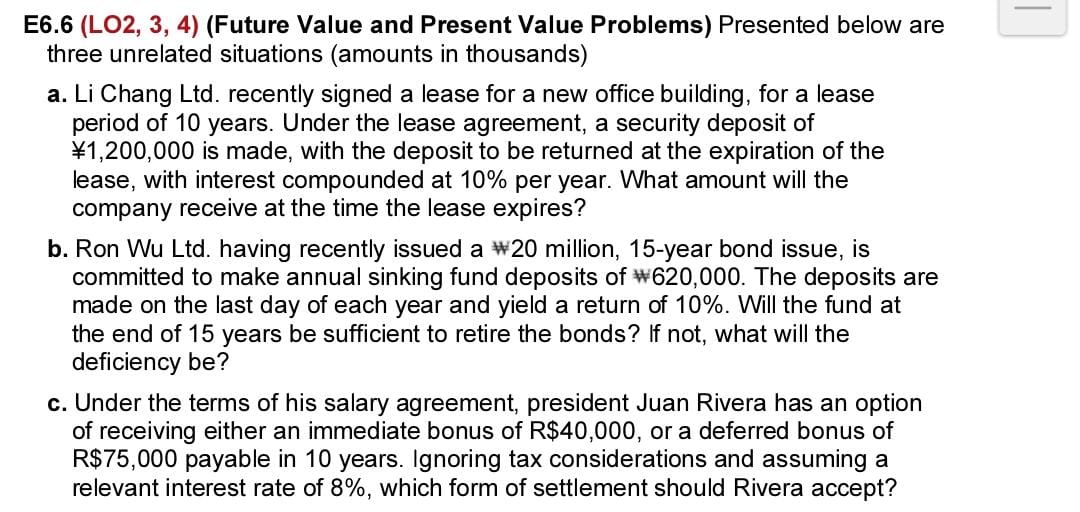

Question: E6.6 (L02, 3, 4) (Future Value and Present Value Problems) Presented below are three unrelated situations (amounts in thousands) a. Li Chang Ltd. recently signed

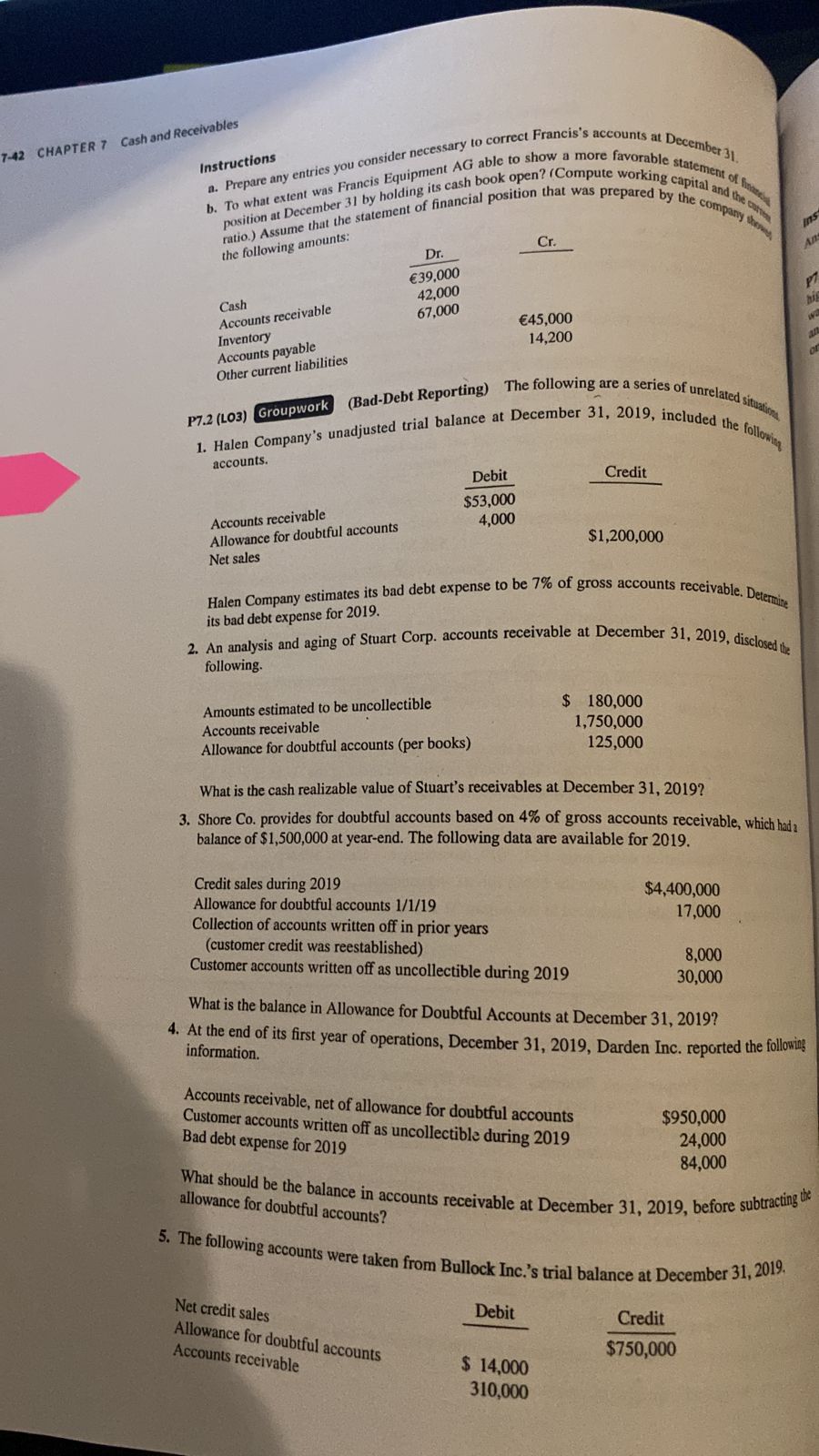

E6.6 (L02, 3, 4) (Future Value and Present Value Problems) Presented below are three unrelated situations (amounts in thousands) a. Li Chang Ltd. recently signed a lease for a new ofce building, for a lease period of 10 years. Under the lease agreement, a security deposit of 1,200,000 is made, with the deposit to be returned at the expiration of the lease, with interest compounded at 10% per year. What amount will the company receive at the time the lease expires? b. Ron Wu Ltd. having recently issued a $20 million, 15year bond issue, is committed to make annual sinking fund deposits of $620,000. The deposits are made on the last day of each year and yield a return of 10%. Will the fund at the end of 15 years be sufcient to retire the bonds? If not, what will the deciency be? c. Under the terms of his salary agreement, president Juan Rivera has an option of receiving either an immediate bonus of R$40,000, or a deferred bonus of R$75,000 payable in 10 years. Ignoring tax considerations and assuming a relevant interest rate of 8%, which form of settlement should Rivera accept? 7-42 CHAPTER 7 Cash and Receivables Instructions "Prepare any entries you consider necessary to correct Francis's accounts at December al " 10 what extent was Francis Equipment AG able to show a more favorable statement of Position at December 31 by holding its cash book open? (Compute working capital and the 0.) Assume that the statement of financial position that was prepared by the company theft the following amounts: Cr. Dr. E39.000 42,000 Cash Accounts receivable 67,000 E45,000 Inventory 14,200 Accounts payable Other current liabilities P7.2 (L03) Groupwork (Bad-Debt Reporting) The following are a series of unrelated situa 1. Halen Company's unadjusted trial balance at December 31, 2019, included the followin accounts. Debit Credit $53,000 Accounts receivable 4,000 Allowance for doubtful accounts $1,200,000 Net sales Halen Company estimates its bad debt expense to be 7% of gross accounts receivable. Determine its bad debt expense for 2019. 2. An analysis and aging of Stuart Corp. accounts receivable at December 31, 2019, disclosed the following. Amounts estimated to be uncollectible $ 180,000 Accounts receivable 1,750,000 Allowance for doubtful accounts (per books) 125,000 What is the cash realizable value of Stuart's receivables at December 31, 2019? 3. Shore Co. provides for doubtful accounts based on 4% of gross accounts receivable, which had a balance of $1,500,000 at year-end. The following data are available for 2019. Credit sales during 2019 $4,400,000 Allowance for doubtful accounts 1/1/19 17,000 Collection of accounts written off in prior years (customer credit was reestablished) Customer accounts written off as uncollectible during 2019 8,000 30,000 What is the balance in Allowance for Doubtful Accounts at December 31, 2019? information. 4. At the end of its first year of operations, December 31, 2019, Darden Inc. reported the following Accounts receivable, net of allowance for doubtful accounts Customer accounts written off as uncollectible during 2019 $950,000 Bad debt expense for 2019 24,000 84,000 What should be the balance in accounts receivable at December 31, 2019, before subtracting the allowance for doubtful accounts? 5. The following accounts were taken from Bullock Inc.'s trial balance at December 31, 2019. Net credit sales Debit Credit Allowance for doubtful accounts Accounts receivable $750,000 $ 14,000 310,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts