Question: E6-8 Recording Bad Debt Expense Estimates and Write-Offs Using the Percentage of Credit Sales Method LO6-2 During the current year, Sun Electronics, Incorporated, recorded credit

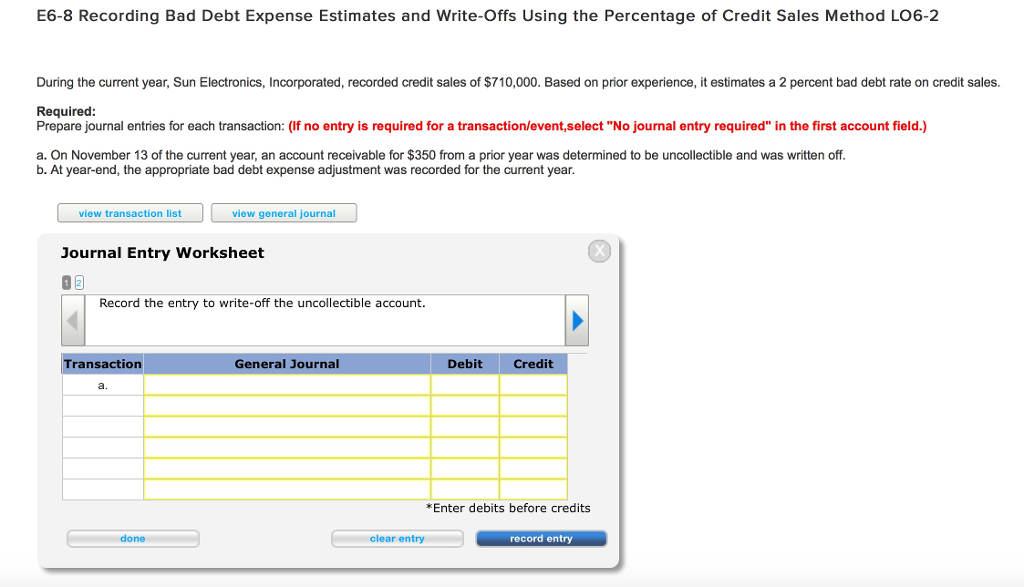

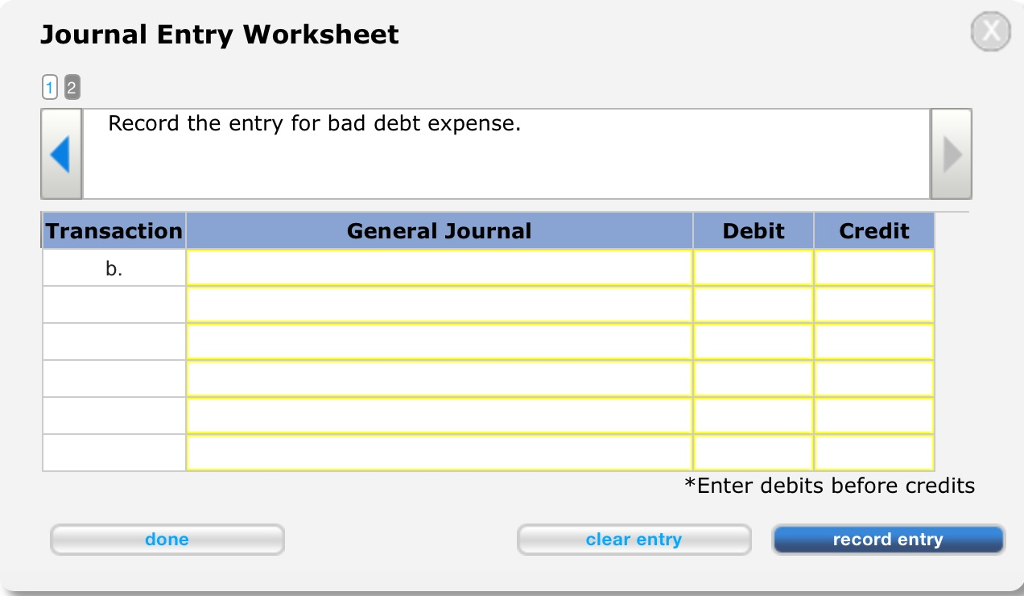

E6-8 Recording Bad Debt Expense Estimates and Write-Offs Using the Percentage of Credit Sales Method LO6-2 During the current year, Sun Electronics, Incorporated, recorded credit sales of $710,000. Based on prior experience, it estimates a 2 percent bad debt rate on credit sales. Required: Prepare journal entries for each transaction: (lfno entry is required for atransaction/event,select "No journal entry required" in the first account field.) a. On November 13 of the current year, an account receivable for $350 from a prior year was determined to be uncollectible and was written off. b. At year-end, the appropriate bad debt expense adjustment was recorded for the current year. view transaction list view general journal Journal Entry worksheet 12 Record the entry to write off the uncollectible account. Transaction General Journal Debit Credit *Enter debits before credits done clear entry record entry

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts