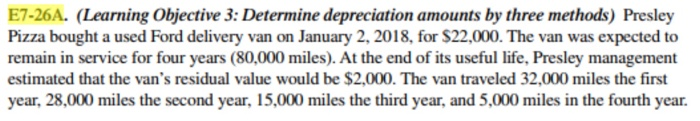

Question: E7-26A. (Learning Objective 3: Determine depreciation amounts by three methods) Presley Pizza bought a used Ford delivery van on January 2, 2018, for $22,000. The

E7-26A. (Learning Objective 3: Determine depreciation amounts by three methods) Presley Pizza bought a used Ford delivery van on January 2, 2018, for $22,000. The van was expected to remain in service for four years (80,000 miles). At the end of its useful life, Presley management estimated that the van's residual value would be $2,000. The van traveled 32,000 miles the first year, 28,000 miles the second year, 15,000 miles the third year, and 5,000 miles in the fourth year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts