Question: E7.7 Determine bad debts expense, and prepare the adjusting entry LO8 Marc Pty Ltd has accounts receivable of S92500 at 31 March 2019. An analysis

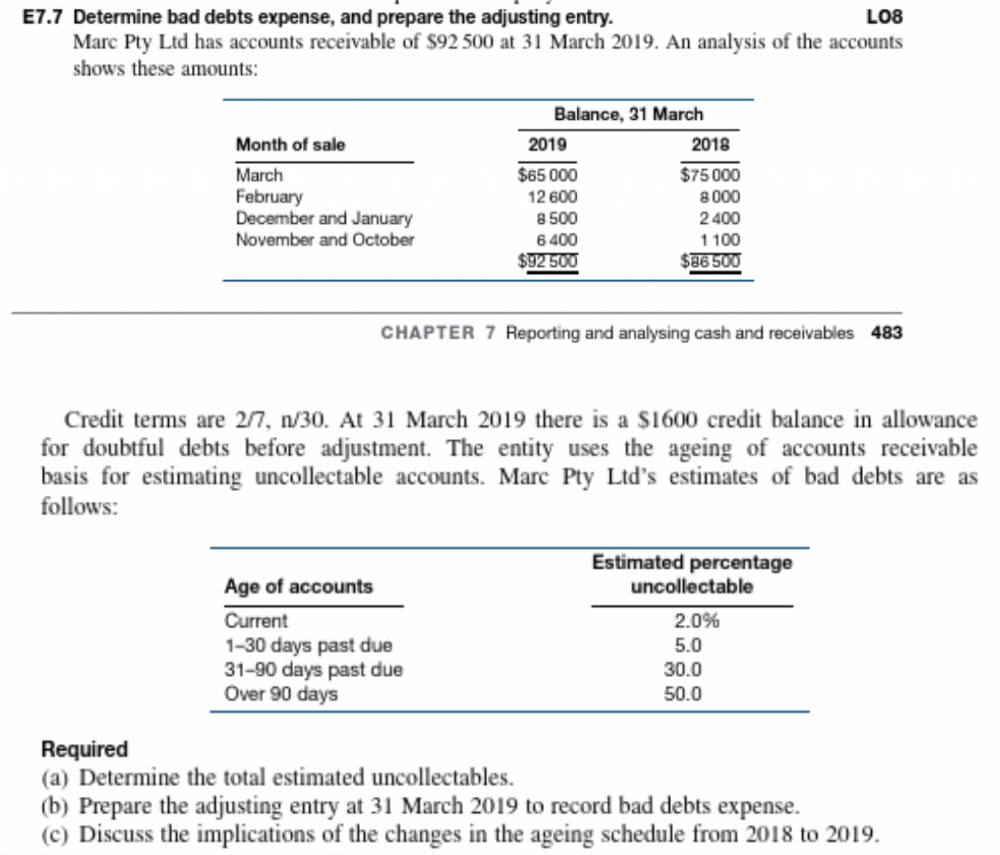

E7.7 Determine bad debts expense, and prepare the adjusting entry LO8 Marc Pty Ltd has accounts receivable of S92500 at 31 March 2019. An analysis of the accounts shows these amounts: Balance, 31 March Month of sale March February December and January November and October 2019 2018 $65 000 12 600 8500 6 400 $75000 8000 2400 1 100 $86500 CHAPTER 7 Reporting and analysing cash and receivables 483 Credit terms are 2/7, n/30. At 31 March 2019 there is a $1600 credit balance in allowance for doubtful debts before adjustment. The entity uses the ageing of accounts receivable basis for estimating uncollectable accounts. Marc Pty Ltd's estimates of bad debts are as follows: Age of accounts Current 1-30 days past due 31-90 days past due Over 90 days Estimated percentage uncollectable 2.0% 5.0 30.0 50.0 Required (a) Determine the total estimated uncollectables. (b) Prepare the adjusting entry at 31 March 2019 to record bad debts expense. (c) Discuss the implications of the changes in the ageing schedule from 2018 to 2019

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts