Question: E8-1 (Static) Recording Bad Debt Expense Estimates and Write-Offs Using the Aging of Receivables Method [LO 8-2] Blackhorse Productions, Incorporated, used the aging of accounts

![Aging of Receivables Method [LO 8-2] Blackhorse Productions, Incorporated, used the aging](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e679ff2ddf5_54266e679fec4a72.jpg)

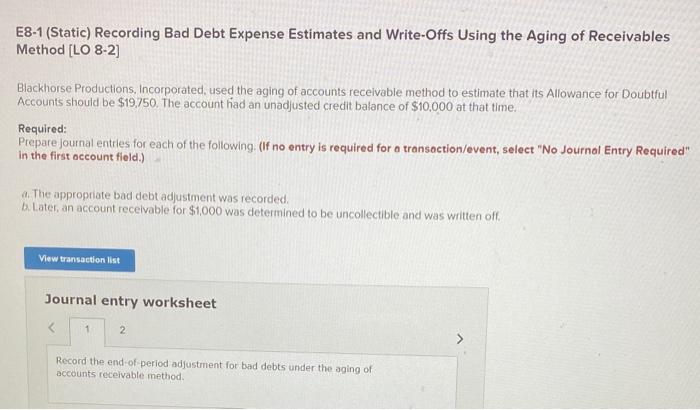

E8-1 (Static) Recording Bad Debt Expense Estimates and Write-Offs Using the Aging of Receivables Method [LO 8-2] Blackhorse Productions, Incorporated, used the aging of accounts receivable method to estimate that its Allowance for Doubtful Accounts should be $19,750. The account had an unadjusted credit balance of $10,000 at that time. Required: Prepare journal entries for each of the following. (If no entry is required for a transoction/event, select "No Journal Entry Required" in the first occount field.) a. The appropriate bad debt adjustment was recorded. b. Later, an account recelvable for $1,000 was determined to be uncollectible and was written off. Journal entry worksheet 2 Record the end-of period adjustment for bad debts under the aging of accounts receivable method. Accounts should be $19,750. The account had an unadjusted credit balance of $10,000 at that time. Required: Prepare journal entries for each of the following. (If no entry is required for a transoction/event, select "No in the first account field.) a. The appropriate bad debt adjustment was recorded. b. Later, an account receivable for $1,000 was determined to be uncollectible and was written off. Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts