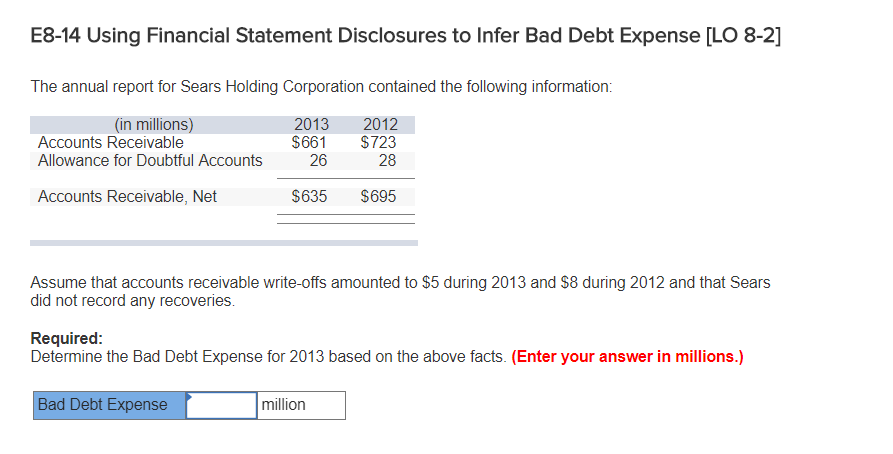

Question: E8-14 Using Financial Statement Disclosures to Infer Bad Debt Expense [LO 8-2] The annual report for Sears Holding Corporation contained the following information: 2013 2012

E8-14 Using Financial Statement Disclosures to Infer Bad Debt Expense [LO 8-2] The annual report for Sears Holding Corporation contained the following information: 2013 2012 S661 $723 Allowance for Doubtful Accounts 26 28 r illis) Accounts Receivable Accounts Receivable, Net $635 $695 Assume that accounts receivable write-offs amounted to $5 during 2013 and S8 during 2012 and that Sears did not record any recoveries. Required Determine the Bad Debt Expense for 2013 based on the above facts. (Enter your answer in millions.) Bad Debt Expense million

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock