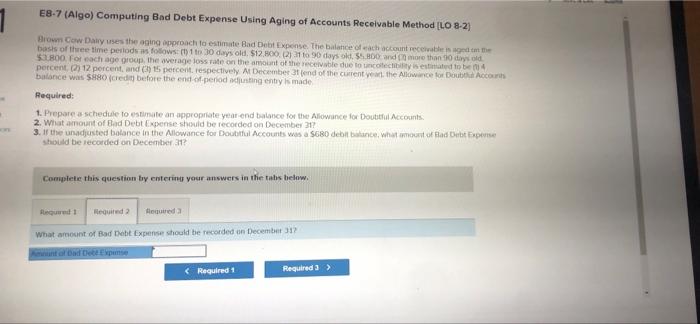

Question: E8-7 (Algo) Computing Bad Debt Expense Using Aging of Accounts Receivable Method [LO 8-21 Brown Cow Daly uses the aging proach to estimate Bad Debt

E8-7 (Algo) Computing Bad Debt Expense Using Aging of Accounts Receivable Method [LO 8-21 Brown Cow Daly uses the aging proach to estimate Bad Debt Expense. The balance of each account receivables get me basis of three time periods as fotos: (1) 30 days old. $12.00 2121 to 90 days old and more than 10 days old 1800 for each age group the werage loss rate on the amount of the receivable due to uncoctis estimated to be percent (2) 12 percent, and Ch 15 percent respectively Al December at end of the current year, the Allowance for Double Account balance was $180 credit before the end of period adjusting entry is made Required: 1. Prepare a schedule to estimate an appropriate year end balance for the Allowance for Doutit Accounts 2. What amount of Bad Debt Expense should be recorded on December 31 3. If the unadjusted balance in the Allowance for Doubtful Accounts was a SGBD debit balance, what amount of flad Debt Dene should be recorded on December 31 Complete this question by entering your answers in the tabs below. Requud 1 Required queda What amount of Bad Debt Expense should be recorded on December 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts