Question: E8-8 Recording and Reporting Allowance for Doubtful Accounts Using the Percentage of Credit Sales and Aging of Accounts Receivable Methods [LO 8-2] Innovative Tech Inc.

![of Credit Sales and Aging of Accounts Receivable Methods [LO 8-2] Innovative](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e891e512878_73266e891e49e6cb.jpg)

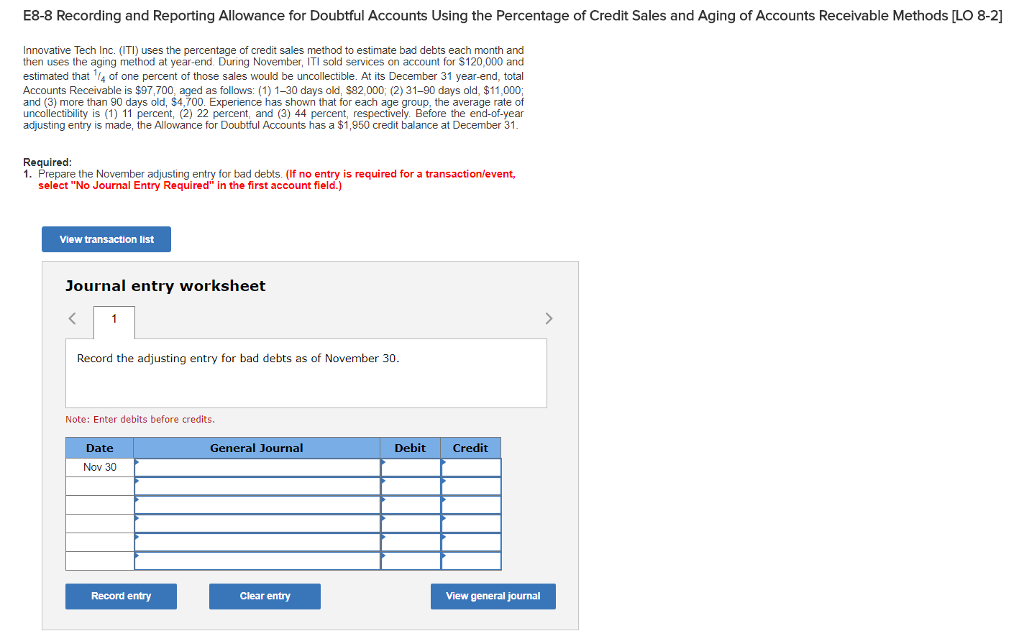

E8-8 Recording and Reporting Allowance for Doubtful Accounts Using the Percentage of Credit Sales and Aging of Accounts Receivable Methods [LO 8-2] Innovative Tech Inc. (ITI) uses the percentage of credit sales method to estimate bad debts each month and then uses the aging method at year-end During November, sold services on account for S120000 and estimated that / of one percent of those sales would be uncollectible. At its December 31 year-end, total Accounts Receivable is $97,700, aged as follows: (1) 1-30 days old, $82,000, (2) 31-90 days old, $11,000 and (3) more than 90 days old, $4700. Experience has shown that for each age group, the average rate of uncollectibility is (1) 11 percent, (2) 22 percent, and (3) 44 percent, respectively. Before the end-of-year adjusting entry is made, the Allowance for Doubtful Accounts has a $1,950 credit balance at December 31 Required 1. 1. Prepare the November adjusting entry for bad debts. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet Record the adjusting entry for bad debts as of November 30 Note: Enter debits before credits. Date General Journal Debit Credit t Credit Nov 30 Record entry Clear entry View general journal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts